ST

Supercat Twisty

Answers (6)

ST

Answered

Which of the following is a drawback of behavioral measures of assessing personality?

A) The individual being assessed may look at the same image and see different things at different times.

B) The subjects are assessed in an open environment and observers have no control of the situation.

C) People behave differently when they know that they are being observed.

D) Observers are not permitted to question the subjects beyond 30 minutes.

A) The individual being assessed may look at the same image and see different things at different times.

B) The subjects are assessed in an open environment and observers have no control of the situation.

C) People behave differently when they know that they are being observed.

D) Observers are not permitted to question the subjects beyond 30 minutes.

On Jul 27, 2024

C

ST

Answered

The development level in the SLII model is ______.

A) the degree to which leaders are capable of adjusting their styles

B) the skill with which the followers adjust their styles

C) the traits that make up who a follower is

D) the degree to which followers have the capability and motivation for task accomplishment

A) the degree to which leaders are capable of adjusting their styles

B) the skill with which the followers adjust their styles

C) the traits that make up who a follower is

D) the degree to which followers have the capability and motivation for task accomplishment

On Jul 24, 2024

D

ST

Answered

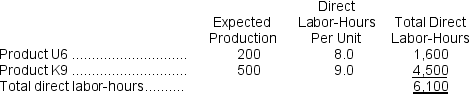

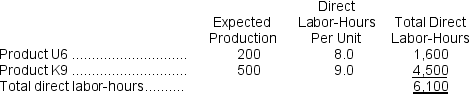

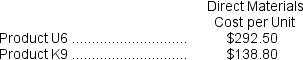

Rutty, Inc., manufactures and sells two products: Product U6 and Product K9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:

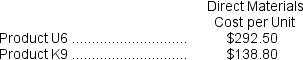

The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

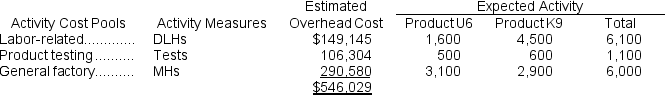

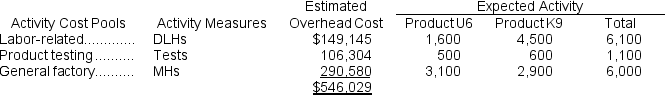

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Determine the unit product cost of each product under the company's traditional costing method.

b.Determine the unit product cost of each product under the activity-based costing method.

The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Determine the unit product cost of each product under the company's traditional costing method.

b.Determine the unit product cost of each product under the activity-based costing method.

On Jun 27, 2024

a.Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $546,029 ÷ 6,100 DLHs = $89.51 per DLH (rounded)

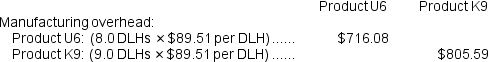

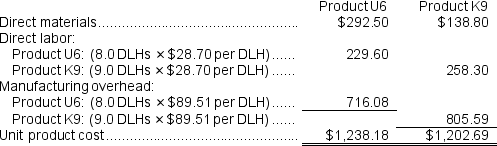

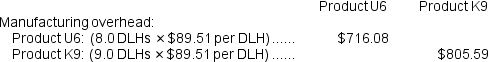

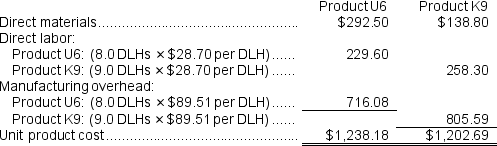

Computation of overhead applied to each product: Computation of traditional unit product costs:

Computation of traditional unit product costs:  b.Computation of activity rates:

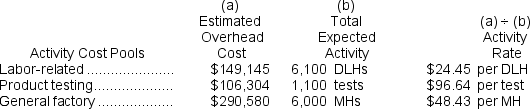

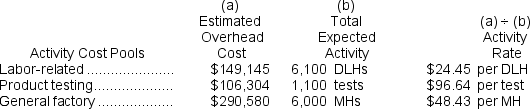

b.Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

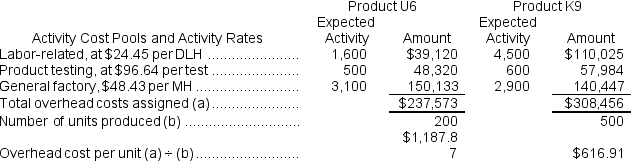

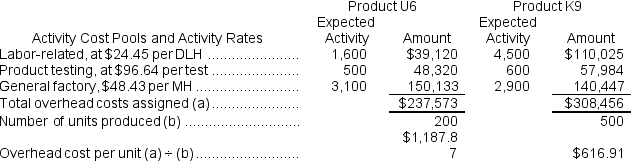

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

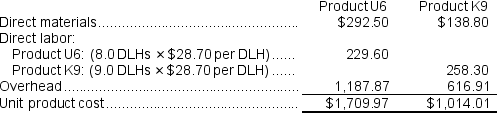

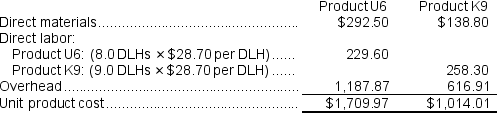

Computation of unit product costs under activity-based costing.

= $546,029 ÷ 6,100 DLHs = $89.51 per DLH (rounded)

Computation of overhead applied to each product:

Computation of traditional unit product costs:

Computation of traditional unit product costs:  b.Computation of activity rates:

b.Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

Computation of unit product costs under activity-based costing.

ST

Answered

Which of the following training methods incorporates more adult learning principles than are used in other training methods?

A) simulations

B) action learning

C) case studies

D) role plays

A) simulations

B) action learning

C) case studies

D) role plays

On Jun 24, 2024

B

ST

Answered

Ron,who has rarely been late to a staff meeting,has just arrived at today's meeting 10 minutes late.Under these circumstances,it is unlikely that participants in the meeting will make conscious causal attributions regarding Ron's behavior.

On May 28, 2024

False

ST

Answered

As set forth in the text, what does the Financial Services Modernization Act, also known as the Gramm-Leach Bliley Act provide regarding financial institutions and customer privacy?

On May 25, 2024

Financial institutions are prohibited from disclosing personal information about their clients to third parties unless certain requirements set forth in the act are met. In addition, financial institutions are legally required to present customers with the institution's privacy policies and practices.