TA

Taryn Ashleigh

Answers (7)

TA

Answered

In the late 1800's deflation caused farmers to suffer as the fall in crop prices reduced their income and thus their ability to pay off their debts.

On Jul 14, 2024

True

TA

Answered

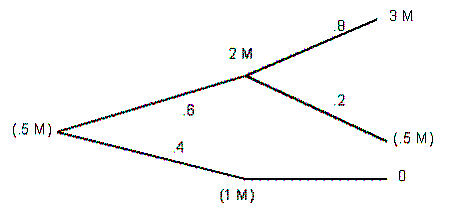

Komarek Forests is considering a new software package that may improve productivity over the next two years. There is a sixty percent chance that the project will be a success in Year 1, earning $2 million and a forty percent change that the venture will fail during the first year resulting in a $1 million loss due to worse asset management than under the current system. The original system would be reinstalled, resulting in no additional losses during the second year. If the project is a success in the first year, there is an eighty percent chance that it will earn $3 million in the second year. There is a twenty percent chance that the software will be ineffective in Year 2, despite success in Year 1, in which case there would be a loss of $500,000. Assuming a nine percent required rate of return on these, and a total cost of the software system of $500,000, should Komarek install the new system?

On Jul 11, 2024

Path 1: Probability: 0.6 × 0.8 = 0.48

Path 1: Probability: 0.6 × 0.8 = 0.48 CF0 = -500,000 CF1 = $2,000,000 CF2 = $3,000,000 I = 9 Solve for NPV = $3,859,902

Path 2: Probability: 0.6 × 0.2 = 0.12

CF0 = -500,000 CF1 = $2,000,000 CF2 = -$500,000 I = 9 Solve for NPV = $914,022

Path 3: Probability: 0.4

CF0 = -500,000 CF1 = -1,000,000 I = 9 Solve for NPV = -$1,417,431

Expected Value = .48 ($3,859,902) + .12 ($914,022) + 0.4 (-$1,417,431)

$1,852,753 + $109,683 - $566,972 = $1,395,464

The present value of the project is a positive $1,395,464. However, there is forty percent chance of losing $1,417,431. Komarek Forests may conclude that the chance of loss is too great, and forego this positive NPV project.

TA

Answered

Early payment discount offered to customers by the seller.

A)Freight

B)Delivery Expense

C)Inventory

D)Sales discount

E)Purchases Returns and Allowances

F)Debit memo

G)Purchases discount

H)Trade discount

A)Freight

B)Delivery Expense

C)Inventory

D)Sales discount

E)Purchases Returns and Allowances

F)Debit memo

G)Purchases discount

H)Trade discount

On Jun 14, 2024

d

TA

Answered

______ include lack of communication, incompatible personalities, and collisions in value systems.

A) Antecedents of conflict

B) Functions of conflict

C) Dysfunctions of conflict

D) Outcomes of conflict

A) Antecedents of conflict

B) Functions of conflict

C) Dysfunctions of conflict

D) Outcomes of conflict

On Jun 11, 2024

A

TA

Answered

Anna's Antiques expects to get two bidders for the unique china teacup it sells.Each of the bidders can either have a high-value of $100 or a low-value of $70 with equal probability.If Anna instead holds an oral auction between the two bidders and one bidder of each type shows up,she earn ___ from the auction.

A) Just above $100

B) $100

C) Just above $70

D) $70

A) Just above $100

B) $100

C) Just above $70

D) $70

On May 15, 2024

C

TA

Answered

The equation for computing interest on an interest-bearing note is as follows: Interest = Maturity Value × Interest Rate × Time.

On May 12, 2024

False

TA

Answered

Risky securities have higher average returns than riskless securities.

On May 11, 2024

True