TT

Terry Thompson

Answers (8)

TT

Answered

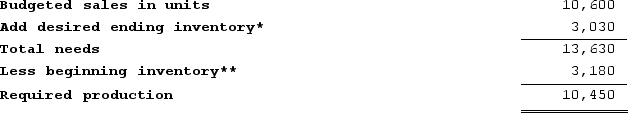

Botz Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:> The budgeted selling price per unit is $94. Budgeted unit sales for April, May, June, and July are 8,200, 10,600, 10,100, and 15,200 units, respectively. All sales are on credit.> Regarding credit sales, 40% are collected in the month of the sale and 60% in the following month.> The ending finished goods inventory equals 30% of the following month's sales.> The ending raw materials inventory equals 40% of the following month's raw materials production needs. Each unit of finished goods requires 2 pounds of raw materials. The raw materials cost $1.00 per pound.> Regarding raw materials purchases, 10% are paid for in the month of purchase and 90% in the following month.> The direct labor wage rate is $23.00 per hour. Each unit of finished goods requires 2.4 direct labor-hours.Required:a. What are the budgeted sales for May?b. What are the expected cash collections for May?c. What is the budgeted accounts receivable balance at the end of May?d. According to the production budget, how many units should be produced in May?e. If 23,260 pounds of raw materials are needed for production in June, how many pounds of raw materials should be purchased in May?f. What is the estimated cost of raw materials purchases for May?g. If the cost of raw material purchases in April is $19,064, then in May what are the total estimated cash disbursements for raw materials purchases?h. What is the estimated accounts payable balance at the end of May?i. What is the estimated raw materials inventory balance at the end of May?j. What is the total estimated direct labor cost for May assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?k. For simplicity, we will assume that there is no fixed manufacturing overhead and that the variable manufacturing overhead is $11.00 per direct labor-hour. What is the estimated unit product cost?l. What is the estimated finished goods inventory balance at the end of May?

On Jul 30, 2024

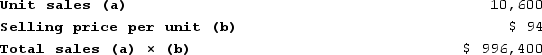

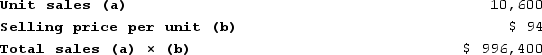

a. The budgeted sales for May are computed as follows:

b. The expected cash collections for May are computed as follows:

b. The expected cash collections for May are computed as follows:

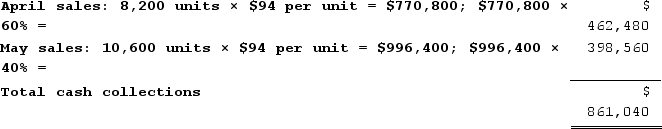

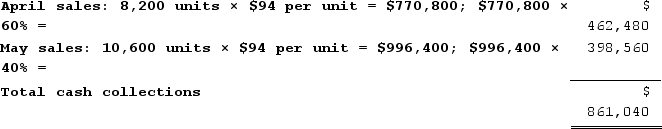

c. The budgeted accounts receivable balance at the end of May is:

c. The budgeted accounts receivable balance at the end of May is:

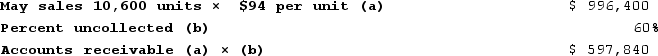

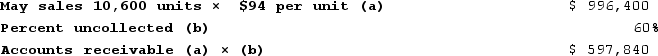

d. The budgeted required production for May is computed as follows:

d. The budgeted required production for May is computed as follows:

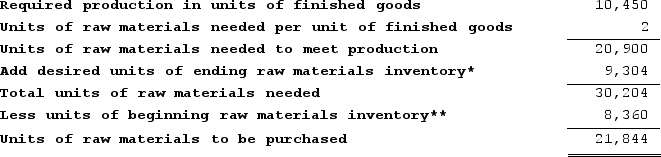

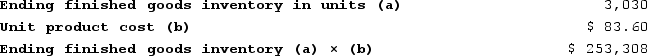

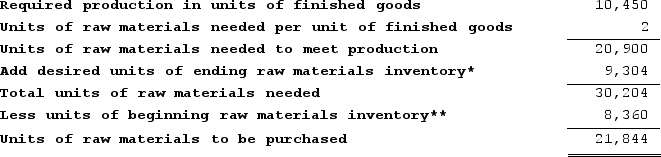

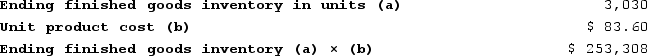

*June sales of 10,100 units × 30% = 3,030 units** May sales of 10,600 units × 30% = 3,180 unitse. The budgeted raw material purchases for May are computed as follows:

*June sales of 10,100 units × 30% = 3,030 units** May sales of 10,600 units × 30% = 3,180 unitse. The budgeted raw material purchases for May are computed as follows:

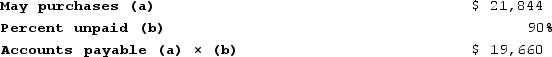

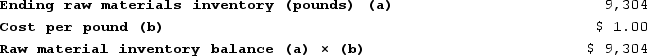

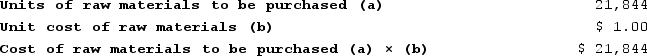

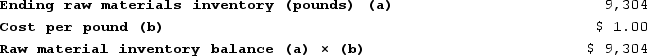

* 23,260 pounds × 40% = 9,304 pounds.** 20,900 pounds × 40% = 8,360 pounds.f. The budgeted cost of raw material purchases for May is computed as follows:

* 23,260 pounds × 40% = 9,304 pounds.** 20,900 pounds × 40% = 8,360 pounds.f. The budgeted cost of raw material purchases for May is computed as follows:

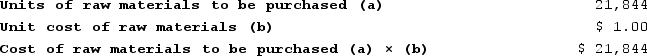

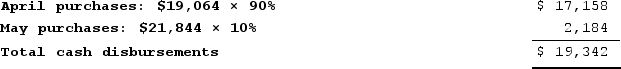

g. The estimated cash disbursements for materials purchases in May is computed as follows:

g. The estimated cash disbursements for materials purchases in May is computed as follows:

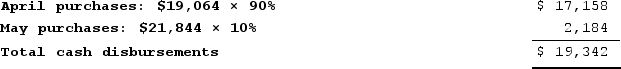

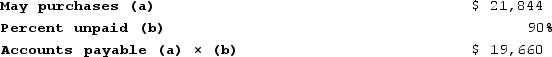

h. The budgeted accounts payable balance at the end of May is:

h. The budgeted accounts payable balance at the end of May is:

i. The estimated raw materials inventory balance at the end of May is computed as follows:

i. The estimated raw materials inventory balance at the end of May is computed as follows:

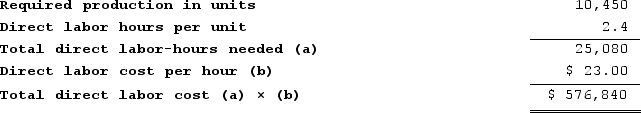

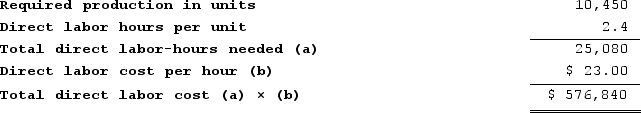

j. The estimated direct labor cost for May is computed as follows:

j. The estimated direct labor cost for May is computed as follows:

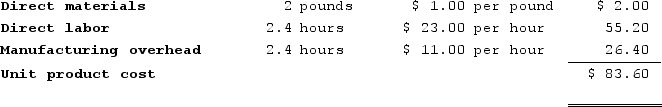

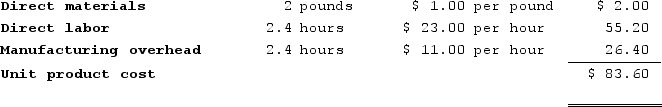

k. The estimated unit product cost is computed as follows:

k. The estimated unit product cost is computed as follows:

l. The estimated finished goods inventory balance at the end of May is computed as follows:

l. The estimated finished goods inventory balance at the end of May is computed as follows:

b. The expected cash collections for May are computed as follows:

b. The expected cash collections for May are computed as follows: c. The budgeted accounts receivable balance at the end of May is:

c. The budgeted accounts receivable balance at the end of May is: d. The budgeted required production for May is computed as follows:

d. The budgeted required production for May is computed as follows: *June sales of 10,100 units × 30% = 3,030 units** May sales of 10,600 units × 30% = 3,180 unitse. The budgeted raw material purchases for May are computed as follows:

*June sales of 10,100 units × 30% = 3,030 units** May sales of 10,600 units × 30% = 3,180 unitse. The budgeted raw material purchases for May are computed as follows: * 23,260 pounds × 40% = 9,304 pounds.** 20,900 pounds × 40% = 8,360 pounds.f. The budgeted cost of raw material purchases for May is computed as follows:

* 23,260 pounds × 40% = 9,304 pounds.** 20,900 pounds × 40% = 8,360 pounds.f. The budgeted cost of raw material purchases for May is computed as follows: g. The estimated cash disbursements for materials purchases in May is computed as follows:

g. The estimated cash disbursements for materials purchases in May is computed as follows: h. The budgeted accounts payable balance at the end of May is:

h. The budgeted accounts payable balance at the end of May is: i. The estimated raw materials inventory balance at the end of May is computed as follows:

i. The estimated raw materials inventory balance at the end of May is computed as follows: j. The estimated direct labor cost for May is computed as follows:

j. The estimated direct labor cost for May is computed as follows: k. The estimated unit product cost is computed as follows:

k. The estimated unit product cost is computed as follows: l. The estimated finished goods inventory balance at the end of May is computed as follows:

l. The estimated finished goods inventory balance at the end of May is computed as follows:

TT

Answered

Perishable products tend to have relatively short credit periods.

On Jul 27, 2024

True

TT

Answered

A(n) __________ is a method of discharging a contract in which a third party becomes bound upon a promise to the obligee.

A) assignment

B) delegation

C) partial assignment

D) novation

A) assignment

B) delegation

C) partial assignment

D) novation

On Jun 30, 2024

D

TT

Answered

If you expect a favorable response to your message,where can you place your recommendations?

A) Up front

B) After each key point

C) After each piece of supporting evidence

D) In the recommendation section

E) At the end

A) Up front

B) After each key point

C) After each piece of supporting evidence

D) In the recommendation section

E) At the end

On Jun 27, 2024

A

TT

Answered

Common carriers are not permitted to limit their liability for damage to bailed goods.

On May 31, 2024

False

TT

Answered

The conduct of Edie and Floyd indicate an intention to create a trust. The circumstances raise an inference that Edie is holding legal title to property for Floyd's benefit. This is

A) not a trust.

B) a living trust.

C) a resulting trust.

D) a constructive trust.

A) not a trust.

B) a living trust.

C) a resulting trust.

D) a constructive trust.

On May 28, 2024

C

TT

Answered

The input cost changes that occur after the purchase of inventory items in a current cost accounting system are recognized as

A) realized gains and losses.

B) unrealized holding gains and losses.

C) extraordinary gains and losses.

D) costs of goods solD.

A) realized gains and losses.

B) unrealized holding gains and losses.

C) extraordinary gains and losses.

D) costs of goods solD.

On Apr 28, 2024

B