VE

Valentina Etchepare

Answers (6)

VE

Answered

Younie Corporation has two divisions: the South Division and the West Division.The corporation's net operating income is $26,900.The South Division's divisional segment margin is $42,800 and the West Division's divisional segment margin is $29,900.What is the amount of the common fixed expense not traceable to the individual divisions?

A) $56,800

B) $69,700

C) $72,700

D) $45,800

A) $56,800

B) $69,700

C) $72,700

D) $45,800

On Jul 12, 2024

D

VE

Answered

Use of cross-functional teams and task forces is one way of trying to minimize __________ and promote more creative and efficient operations.

A) interpersonal conflict

B) intragroup conflict

C) intergroup conflict

D) interorganizational conflict

E) extra-organizational conflict

A) interpersonal conflict

B) intragroup conflict

C) intergroup conflict

D) interorganizational conflict

E) extra-organizational conflict

On Jul 11, 2024

C

VE

Answered

What is meant by "beaten path?" How does it influence immigration decisions?

On Jun 12, 2024

Beaten paths refers to migration routes taken previously by family, relatives, friends, and other migrants. The immigrants also tend to cluster in cities and neighborhoods populated by former and current immigrants of the same nationality. Earlier immigrants ease the transition for later immigrants by providing job information, employment contacts, temporary living quarters, language help, and cultural continuity.

VE

Answered

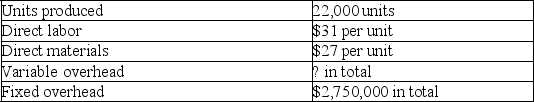

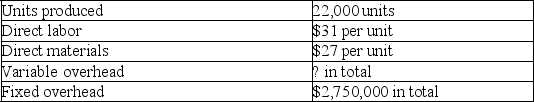

A company reports the following information regarding its production cost:

Required: Perform the following independent calculations.

Required: Perform the following independent calculations.

a.Compute total variable overhead cost if the production cost per unit under variable costing is $240.

b.Compute total variable overhead cost if the production cost per unit under absorption costing is $240.

Required: Perform the following independent calculations.

Required: Perform the following independent calculations.a.Compute total variable overhead cost if the production cost per unit under variable costing is $240.

b.Compute total variable overhead cost if the production cost per unit under absorption costing is $240.

On Jun 11, 2024

a.$31 DL + $27 DM + (VOH/22,000)VOH = $240

VOH/22,000 = $182

Total variable overhead = ($182 × 22,000)= $4,004,000

b.$31 DL + $27 DM + (VOH/22,000)+ ($2,750,000/22,000)FOH = $240

VOH/22,000 = $57

Total variable overhead = ($57 × 22,000)$1,254,000 total variable overhead

VOH/22,000 = $182

Total variable overhead = ($182 × 22,000)= $4,004,000

b.$31 DL + $27 DM + (VOH/22,000)+ ($2,750,000/22,000)FOH = $240

VOH/22,000 = $57

Total variable overhead = ($57 × 22,000)$1,254,000 total variable overhead

VE

Answered

Credit extended from one business to another business is known as which of the following?

A) trade credit

B) consumer credit

C) courtesy credit

D) extensive credit

A) trade credit

B) consumer credit

C) courtesy credit

D) extensive credit

On May 13, 2024

A

VE

Answered

Under which of the following circumstances does a holder taking an instrument for value not become a holder in due course?

A) If the holder acquires a security interest or some other lien in the instrument.

B) If the holder purchases the instrument at a judicial sale or under legal process.

C) If the holder takes the instrument for payment of a preceding claim.

D) If the holder performs the promise for which the instrument was issued.

E) If the holder exchanges the instrument for an irrevocable obligation to a third party.

A) If the holder acquires a security interest or some other lien in the instrument.

B) If the holder purchases the instrument at a judicial sale or under legal process.

C) If the holder takes the instrument for payment of a preceding claim.

D) If the holder performs the promise for which the instrument was issued.

E) If the holder exchanges the instrument for an irrevocable obligation to a third party.

On May 12, 2024

B