VS

Vanesa Serna

Answers (6)

VS

Answered

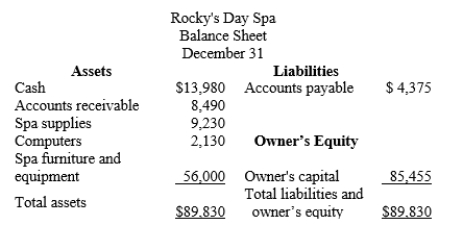

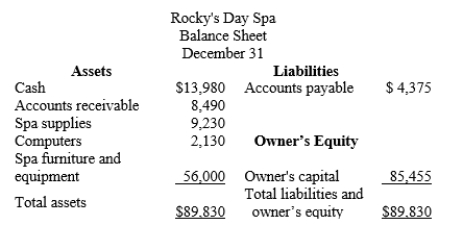

The assets and liabilities of Rocky's Day Spa on December 31 and its revenue and expenses for the year are listed below. The capital of the owner was $68,000 on January 1. The owner invested an additional $10,000 during the year.? Accounts payable $4,375 Spa operating expense $23,760 Accounts receivable 8,490 Office expense 2,470 Cash ??? Spa supplies 9,230 Fees earned 98,435 Wages expense 26,580 Spa furniture and equipment 56,000 Drawing 38,170 Computers 2,130\begin{array} { | l | r | l | r | } \hline \text { Accounts payable } & \$ 4,375 & \text { Spa operating expense } & \$ 23,760 \\\hline \text { Accounts receivable } & 8,490 & \text { Office expense } & 2,470 \\\hline \text { Cash } & ? ? ? & \text { Spa supplies } & 9,230 \\\hline \text { Fees earned } & 98,435 & \text { Wages expense } & 26,580 \\\hline \text { Spa furniture and equipment } & 56,000 & \text { Drawing } & 38,170 \\\hline \text { Computers } & 2,130 & & \\\hline\end{array} Accounts payable Accounts receivable Cash Fees earned Spa furniture and equipment Computers $4,3758,490???98,43556,0002,130 Spa operating expense Office expense Spa supplies Wages expense Drawing $23,7602,4709,23026,58038,170 Prepare a balance sheet for the year ended December 31.?

On Jul 29, 2024

?

VS

Answered

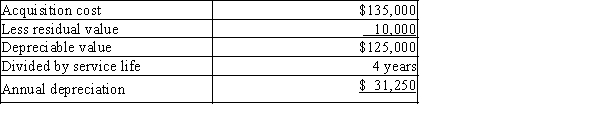

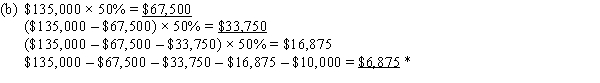

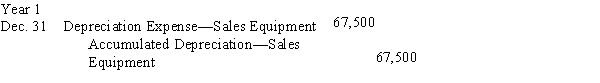

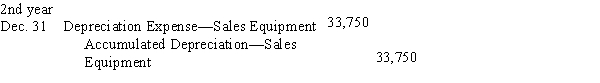

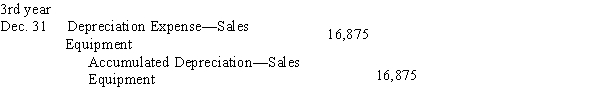

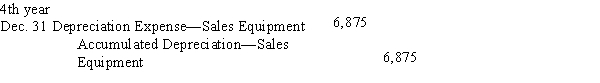

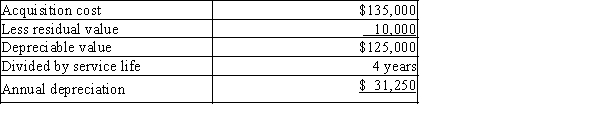

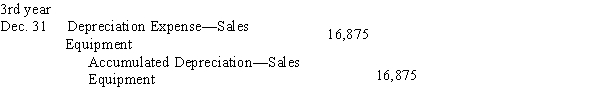

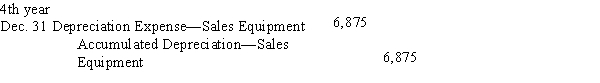

Golden Sales has bought $135,000 in fixed assets on January 1st associated with sales equipment. The residual value of these assets is estimated at $10,000 at the end of their 4-year service life. Golden Sales managers want to evaluate the options of depreciation.

(a) Compute the annual straight-line depreciation and provide the sample depreciation journal entry to be posted

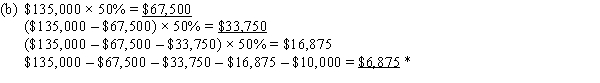

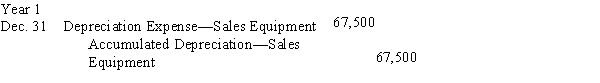

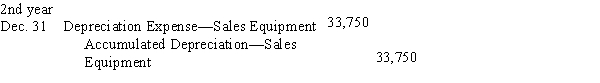

at the end of each of the years.(b) Write the journal entries for each year of the service life for these assets using the double-declining balance

method.

(a) Compute the annual straight-line depreciation and provide the sample depreciation journal entry to be posted

at the end of each of the years.(b) Write the journal entries for each year of the service life for these assets using the double-declining balance

method.

On Jul 27, 2024

(a)  Dec. 31

Dec. 31

Depreciation Expense-Sales Equipment

31,250

Accumulated Depreciation-Sales Equipment

31,250 *Depreciation cannot bring book value below $10,000 residual.

*Depreciation cannot bring book value below $10,000 residual.

Dec. 31

Dec. 31Depreciation Expense-Sales Equipment

31,250

Accumulated Depreciation-Sales Equipment

31,250

*Depreciation cannot bring book value below $10,000 residual.

*Depreciation cannot bring book value below $10,000 residual.

VS

Answered

People who score low on Fiedler's "Least Preferred Coworker" scale can actually be highly ______ leaders.

On Jun 29, 2024

effective

VS

Answered

Research on self-determination theory across cultures found that

A) five psychological needs are related to autonomous motivation in all countries.

B) no one psychological need is related to autonomous motivation in all countries.

C) two psychological needs are related to autonomous motivation in all countries.

D) three psychological needs are related to autonomous motivation in all countries.

E) one psychological need is related to autonomous motivation in all countries.

A) five psychological needs are related to autonomous motivation in all countries.

B) no one psychological need is related to autonomous motivation in all countries.

C) two psychological needs are related to autonomous motivation in all countries.

D) three psychological needs are related to autonomous motivation in all countries.

E) one psychological need is related to autonomous motivation in all countries.

On Jun 27, 2024

D

VS

Answered

The physical units method of joint cost allocation uses market values in the allocation process.

On May 29, 2024

False

VS

Answered

Which of the following is not one of the irreducible constitutional minimum requirements under Article III of the Constitution?

A) The plaintiff suffered an injury in fact that is concrete, particularized, and actual or imminent.

B) The injury is exclusive to the plaintiff.

C) The injury is fairly traceable to the challenged conduct.

D) The injury is likely to be redressed by a favorable court decision.

A) The plaintiff suffered an injury in fact that is concrete, particularized, and actual or imminent.

B) The injury is exclusive to the plaintiff.

C) The injury is fairly traceable to the challenged conduct.

D) The injury is likely to be redressed by a favorable court decision.

On May 28, 2024

B