YM

Yajanae Marquez

Answers (2)

YM

Answered

The primary objective of recruitment is to make sure that the organization is in compliance with federal laws.

On Sep 24, 2024

False

YM

Answered

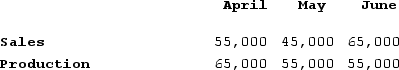

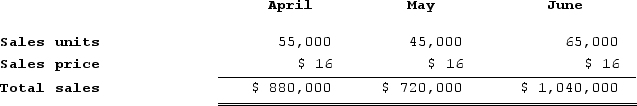

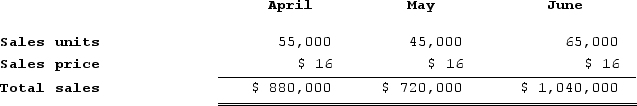

Tilson Corporation has projected sales and production in units for the second quarter of the coming year as follows:

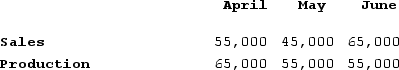

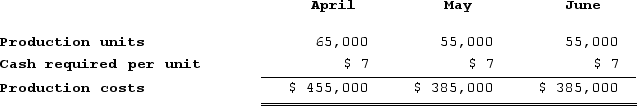

Cash-related production costs are budgeted at $7 per unit produced. Of these production costs, 40% are paid in the month in which they are incurred and the balance in the following month. Selling and administrative expenses will amount to $110,000 per month. The accounts payable balance on March 31 totals $193,000, which will be paid in April.All units are sold on account for $16 each. Cash collections from sales are budgeted at 60% in the month of sale, 30% in the month following the month of sale, and the remaining 10% in the second month following the month of sale. Accounts receivable on April 1 totaled $520,000 ($100,000 from February's sales and $420,000 from March's sales).Required: a. Prepare a schedule for each month showing budgeted cash disbursements for Tilson Corporation.b. Prepare a schedule for each month showing budgeted cash receipts for Tilson Corporation.

Cash-related production costs are budgeted at $7 per unit produced. Of these production costs, 40% are paid in the month in which they are incurred and the balance in the following month. Selling and administrative expenses will amount to $110,000 per month. The accounts payable balance on March 31 totals $193,000, which will be paid in April.All units are sold on account for $16 each. Cash collections from sales are budgeted at 60% in the month of sale, 30% in the month following the month of sale, and the remaining 10% in the second month following the month of sale. Accounts receivable on April 1 totaled $520,000 ($100,000 from February's sales and $420,000 from March's sales).Required: a. Prepare a schedule for each month showing budgeted cash disbursements for Tilson Corporation.b. Prepare a schedule for each month showing budgeted cash receipts for Tilson Corporation.

Cash-related production costs are budgeted at $7 per unit produced. Of these production costs, 40% are paid in the month in which they are incurred and the balance in the following month. Selling and administrative expenses will amount to $110,000 per month. The accounts payable balance on March 31 totals $193,000, which will be paid in April.All units are sold on account for $16 each. Cash collections from sales are budgeted at 60% in the month of sale, 30% in the month following the month of sale, and the remaining 10% in the second month following the month of sale. Accounts receivable on April 1 totaled $520,000 ($100,000 from February's sales and $420,000 from March's sales).Required: a. Prepare a schedule for each month showing budgeted cash disbursements for Tilson Corporation.b. Prepare a schedule for each month showing budgeted cash receipts for Tilson Corporation.

Cash-related production costs are budgeted at $7 per unit produced. Of these production costs, 40% are paid in the month in which they are incurred and the balance in the following month. Selling and administrative expenses will amount to $110,000 per month. The accounts payable balance on March 31 totals $193,000, which will be paid in April.All units are sold on account for $16 each. Cash collections from sales are budgeted at 60% in the month of sale, 30% in the month following the month of sale, and the remaining 10% in the second month following the month of sale. Accounts receivable on April 1 totaled $520,000 ($100,000 from February's sales and $420,000 from March's sales).Required: a. Prepare a schedule for each month showing budgeted cash disbursements for Tilson Corporation.b. Prepare a schedule for each month showing budgeted cash receipts for Tilson Corporation.On Sep 22, 2024

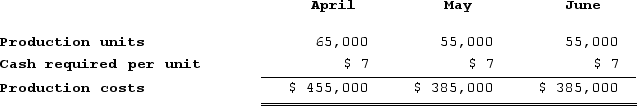

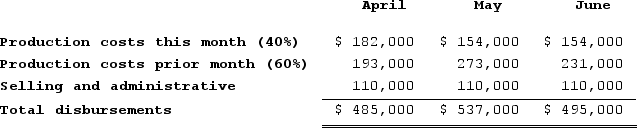

a.

Cash disbursements:

Cash disbursements:

*Payments relating to the prior month (March) in April represent the balance of accounts payable at March 31.b.

*Payments relating to the prior month (March) in April represent the balance of accounts payable at March 31.b.

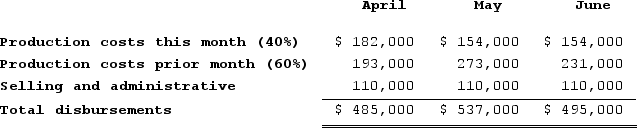

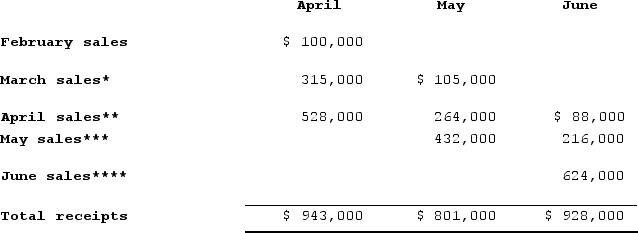

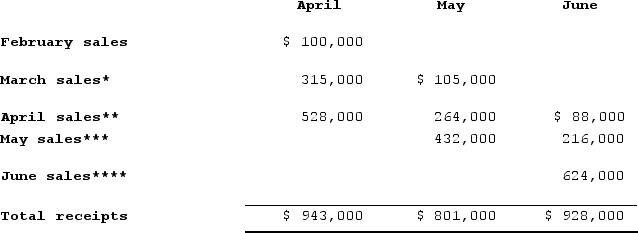

Cash receipts:

Cash receipts:

* $420,000 = 0.40 × March salesMarch sales = $420,000 ÷ 0.40 = $1,050,000March sales collected in April = 0.30 × $1,050,000 = $315,000March sales collected in May = 0.10 × $1,050,000 = $105,000** 0.60 × $880,000; 0.30 × $880,000; 0.10 × $880,000*** 0.60 × $720,000; 0.30 × $720,000**** 0.60 × $1,040,000

* $420,000 = 0.40 × March salesMarch sales = $420,000 ÷ 0.40 = $1,050,000March sales collected in April = 0.30 × $1,050,000 = $315,000March sales collected in May = 0.10 × $1,050,000 = $105,000** 0.60 × $880,000; 0.30 × $880,000; 0.10 × $880,000*** 0.60 × $720,000; 0.30 × $720,000**** 0.60 × $1,040,000

Cash disbursements:

Cash disbursements: *Payments relating to the prior month (March) in April represent the balance of accounts payable at March 31.b.

*Payments relating to the prior month (March) in April represent the balance of accounts payable at March 31.b. Cash receipts:

Cash receipts: * $420,000 = 0.40 × March salesMarch sales = $420,000 ÷ 0.40 = $1,050,000March sales collected in April = 0.30 × $1,050,000 = $315,000March sales collected in May = 0.10 × $1,050,000 = $105,000** 0.60 × $880,000; 0.30 × $880,000; 0.10 × $880,000*** 0.60 × $720,000; 0.30 × $720,000**** 0.60 × $1,040,000

* $420,000 = 0.40 × March salesMarch sales = $420,000 ÷ 0.40 = $1,050,000March sales collected in April = 0.30 × $1,050,000 = $315,000March sales collected in May = 0.10 × $1,050,000 = $105,000** 0.60 × $880,000; 0.30 × $880,000; 0.10 × $880,000*** 0.60 × $720,000; 0.30 × $720,000**** 0.60 × $1,040,000