ZK

Zybrea Knight

Answers (3)

ZK

Answered

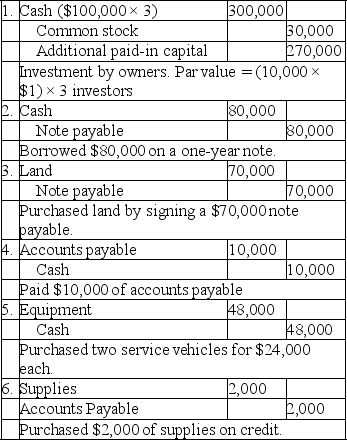

The ABC Corporation was formed on January 1,2019.The three initial owners each invested $100,000 cash and each received 10,000 shares of $1 par value common stock.Below are selected transactions that were completed during January,2019.

1.Issue shares of common stock to the owners.

2.Borrowed $80,000 on a one-year note payable.

3.Purchased land by signing a $70,000 note payable.

4.Paid $10,000 of accounts payable.

5.Purchased two service vehicles for cash at a cost of $24,000 each.

6.Purchased $2,000 of supplies on credit.

Prepare the journal entry on ABC's books for each transaction.Include a brief explanation for each entry.

1.Issue shares of common stock to the owners.

2.Borrowed $80,000 on a one-year note payable.

3.Purchased land by signing a $70,000 note payable.

4.Paid $10,000 of accounts payable.

5.Purchased two service vehicles for cash at a cost of $24,000 each.

6.Purchased $2,000 of supplies on credit.

Prepare the journal entry on ABC's books for each transaction.Include a brief explanation for each entry.

On May 03, 2024

ZK

Answered

What is the deferred tax liability for Sand at December 31,2015?

A) $10,000

B) $15,000

C) $20,000

D) $40,000

A) $10,000

B) $15,000

C) $20,000

D) $40,000

On May 03, 2024

A

ZK

Answered

One criterion that managers sometimes apply in ranking investment proposals is called the:

A) profitability index.

B) annuity index.

C) investment opportunity index.

D) capital ranking approach.

A) profitability index.

B) annuity index.

C) investment opportunity index.

D) capital ranking approach.

On May 02, 2024

A