ZK

Zybrea Knight

Answers (8)

ZK

Answered

What is stereotyping?

On Aug 02, 2024

Stereotyping occurs when attributes are assigned to an individual solely on the basis of his or her membership in a particular social or demographic group.

ZK

Answered

The social loafing effect refers to the tendency for:

A) people in teams to let others make mistakes instead of telling them what to do.

B) teams to take longer to complete a task than individuals.

C) teams to be more creative than individuals,but experience more conflict.

D) people not to work as hard in teams as they would if they were working individually.

A) people in teams to let others make mistakes instead of telling them what to do.

B) teams to take longer to complete a task than individuals.

C) teams to be more creative than individuals,but experience more conflict.

D) people not to work as hard in teams as they would if they were working individually.

On Aug 01, 2024

D

ZK

Answered

The six principles of the Defense Industry Initiative on Business Ethics and Conduct became the foundation for

A) the Foreign Corrupt Practices Act.

B) the Federal Sentencing Guidelines for Organizations.

C) the Ethical Trading Initiative.

D) the Federal Trade Commission compliance requirements.

E) the Sarbanes-Oxley Act.

A) the Foreign Corrupt Practices Act.

B) the Federal Sentencing Guidelines for Organizations.

C) the Ethical Trading Initiative.

D) the Federal Trade Commission compliance requirements.

E) the Sarbanes-Oxley Act.

On Jul 02, 2024

B

ZK

Answered

The nominal group technique of decision making uses a highly structured meeting agenda to allow everyone to contribute ideas without the interference of others' evaluative comments.

On Jul 01, 2024

True

ZK

Answered

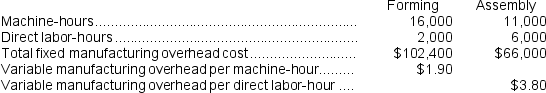

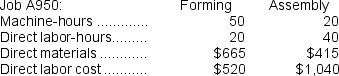

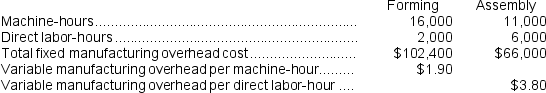

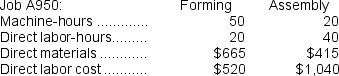

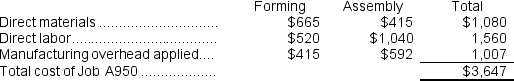

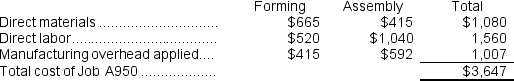

Amason Corporation has two production departments, Forming and Assembly.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A950.The following data were recorded for this job:

During the current month the company started and finished Job A950.The following data were recorded for this job:  Required:

Required:

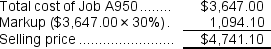

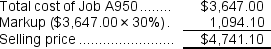

Calculate the selling price for Job A950 if the company marks up its unit product costs by 30% to determine selling prices.

During the current month the company started and finished Job A950.The following data were recorded for this job:

During the current month the company started and finished Job A950.The following data were recorded for this job:  Required:

Required:Calculate the selling price for Job A950 if the company marks up its unit product costs by 30% to determine selling prices.

On Jun 02, 2024

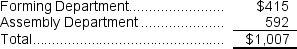

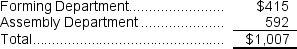

Forming Department:

Forming Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per machine-hour × Total machine-hours in the department)

= $102,400 + ($1.90 per machine-hour × 16,000 machine-hours)

= $102,400 +$30,400 = $132,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $132,800 ÷ 16,000 machine-hours = $8.30 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $8.30 per machine-hour × 50 machine-hours = $415

Assembly Department:

Assembly Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $66,000 + ($3.80 per direct labor-hour × 6,000 direct labor-hours)

= $66,000 + $22,800 = $88,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $88,800 ÷6,000 direct labor-hours = $14.80 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $14.80 per direct labor-hour × 40 direct labor-hours = $592

Overhead applied to Job A950

Forming Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per machine-hour × Total machine-hours in the department)

= $102,400 + ($1.90 per machine-hour × 16,000 machine-hours)

= $102,400 +$30,400 = $132,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $132,800 ÷ 16,000 machine-hours = $8.30 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $8.30 per machine-hour × 50 machine-hours = $415

Assembly Department:

Assembly Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $66,000 + ($3.80 per direct labor-hour × 6,000 direct labor-hours)

= $66,000 + $22,800 = $88,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $88,800 ÷6,000 direct labor-hours = $14.80 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $14.80 per direct labor-hour × 40 direct labor-hours = $592

Overhead applied to Job A950

ZK

Answered

(Figure: PPV) Use Figure: PPV.The figure shows the demand and marginal revenue for a pay-per-view football game on cable TV.Assume that the marginal cost and average cost are a constant $40.If the cable company practices perfect price discrimination,deadweight loss will be:

A) $180.

B) $100.

C) $40.

D) $0.

A) $180.

B) $100.

C) $40.

D) $0.

On Jun 01, 2024

D

ZK

Answered

The easiest type of person to sell a product to is a buyer who is at the unconscious need level.

On May 03, 2024

False

ZK

Answered

Suppose a labor market has perfectly inelastic supply that is composed of union and non-union workers, and both groups of workers initially earn the perfectly competitive wage. What happens to the equilibrium employment level and wage for union workers if the union exercises its bargaining power?

A) Both increase.

B) Employment increases and wage declines.

C) Wage increases and employment declines.

D) Both decline.

A) Both increase.

B) Employment increases and wage declines.

C) Wage increases and employment declines.

D) Both decline.

On May 02, 2024

C