ZK

Zybrea Knight

Answers (6)

ZK

Answered

In brainstorming

A) individuals work in a large group to select a single optimal solution.

B) all solutions are judged and critiqued as they are recorded,and a weighted-average percentage is assigned to each solution.

C) parties are urged to be spontaneous and even impractical.

D) the success of the approach depends on the item-by-item evaluation and critique of the solutions as presented.

E) None of the above is a part of the brainstorming process.

A) individuals work in a large group to select a single optimal solution.

B) all solutions are judged and critiqued as they are recorded,and a weighted-average percentage is assigned to each solution.

C) parties are urged to be spontaneous and even impractical.

D) the success of the approach depends on the item-by-item evaluation and critique of the solutions as presented.

E) None of the above is a part of the brainstorming process.

On Jul 02, 2024

C

ZK

Answered

Wages of assemblers

A)Direct materials

B)Direct labor

C)Factory overhead

D)Nonmanufacturing cost

A)Direct materials

B)Direct labor

C)Factory overhead

D)Nonmanufacturing cost

On Jul 02, 2024

b

ZK

Answered

Which of the following statements regarding backflush costing is false?

A) Backflush costing is simpler and less expensive than traditional product costing.

B) Backflush costing provides more-detailed information than a job order costing system.

C) When using backflush costing, a cost-benefit decision needs to be made.

D) It is only likely to be used in an environment where production-related inventories are kept low.

A) Backflush costing is simpler and less expensive than traditional product costing.

B) Backflush costing provides more-detailed information than a job order costing system.

C) When using backflush costing, a cost-benefit decision needs to be made.

D) It is only likely to be used in an environment where production-related inventories are kept low.

On Jun 05, 2024

B

ZK

Answered

Mary Kay Ash was one of the first individuals who sold cosmetics directly to customers via independent sales representatives. The company founded by Mary Kay is now one of the largest and most successful cosmetics companies in the world. Mary Kay Ash would be classified as a(n)

A) entrepreneur.

B) opportunist.

C) monopolist.

D) socialist.

A) entrepreneur.

B) opportunist.

C) monopolist.

D) socialist.

On Jun 02, 2024

A

ZK

Answered

A married couple has taxable income of $83,125.Determine their marginal tax rate and their average tax rate.(Round your answers to 2 decimal places)

On May 05, 2024

Their marginal tax rate is 25%.Their average tax rate is 14.75%.

ZK

Answered

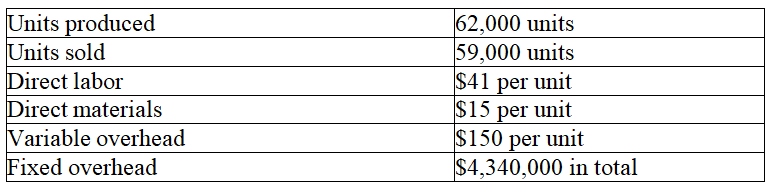

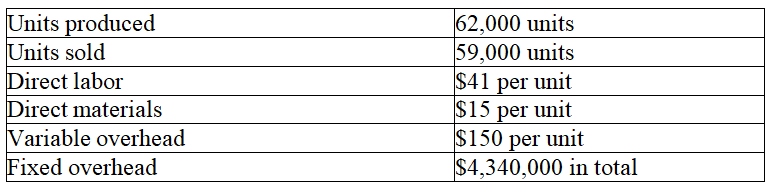

Lukin Corporation reports the following first year production cost information.

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

On May 02, 2024

a.$41 DL + $15 DM + $150 VOH = $206 per unit under variable costing

b.$206 + ($4,340,000/62,000)FOH = $276 per unit under absorption costing

c.(62,000 units - 59,000 units)× $206 per unit = $618,000 ending inventory under variable costing

d.(62,000 units - 59,000 units)× $276 per unit = $828,000 ending inventory under absorption costing

b.$206 + ($4,340,000/62,000)FOH = $276 per unit under absorption costing

c.(62,000 units - 59,000 units)× $206 per unit = $618,000 ending inventory under variable costing

d.(62,000 units - 59,000 units)× $276 per unit = $828,000 ending inventory under absorption costing