ZK

Zybrea Knight

Answers (6)

ZK

Answered

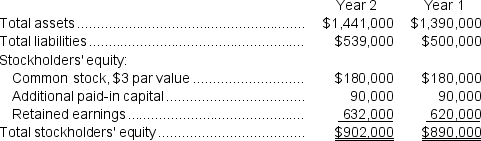

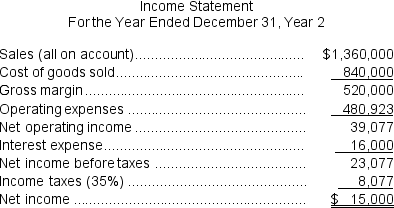

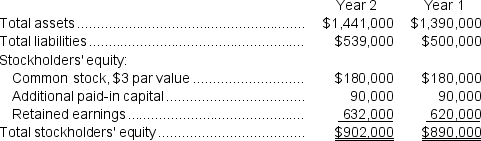

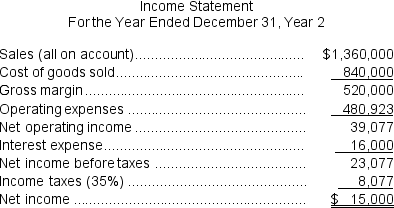

Remley Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $3,000.The market price of common stock at the end of Year 2 was $2.70 per share.

Dividends on common stock during Year 2 totaled $3,000.The market price of common stock at the end of Year 2 was $2.70 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's earnings per share for Year 2?

e.What is the company's price-earnings ratio for Year 2?

f.What is the company's dividend payout ratio for Year 2?

g.What is the company's dividend yield ratio for Year 2?

h.What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $3,000.The market price of common stock at the end of Year 2 was $2.70 per share.

Dividends on common stock during Year 2 totaled $3,000.The market price of common stock at the end of Year 2 was $2.70 per share.Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's earnings per share for Year 2?

e.What is the company's price-earnings ratio for Year 2?

f.What is the company's dividend payout ratio for Year 2?

g.What is the company's dividend yield ratio for Year 2?

h.What is the company's book value per share at the end of Year 2?

On Jul 08, 2024

a.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $39,077 ÷ $16,000 = 2.44 (rounded)

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $539,000 ÷ $902,000 = 0.60 (rounded)

c.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,415,500 ÷ $896,000 = 1.58 (rounded)

*Average total assets = ($1,441,000 + $1,390,000)÷ 2 = $1,415,500

**Average stockholders' equity = ($902,000 + $890,000)÷ 2 = $896,000

d.Earnings per share = Net Income ÷ Average number of common shares outstanding*

= $15,000 ÷ 60,000 shares = $0.25 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $180,000 ÷ $3 per share = 60,000 shares

e.Price-earnings ratio = Market price per share ÷ Earnings per share

= $2.70 ÷ $0.25 = 10.80 (rounded)

f.Dividend payout ratio = Dividends per share* ÷ Earnings per share

= $0.05 ÷ $0.25 = 20.0% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $3,000 ÷ 60,000 shares = $0.05 per share (rounded)

g.Dividend yield ratio = Dividends per share* ÷ Market price per share

= $0.05 ÷ $2.70 = 1.85% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $3,000 ÷ 60,000 shares = $0.05 per share (rounded)

h.Book value per share = Common stockholders' equity ÷ Number of common shares outstanding*

= $902,000 ÷ 60,000 shares = $15.03 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $180,000 ÷ $3 per share = 60,000 shares

= $39,077 ÷ $16,000 = 2.44 (rounded)

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $539,000 ÷ $902,000 = 0.60 (rounded)

c.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,415,500 ÷ $896,000 = 1.58 (rounded)

*Average total assets = ($1,441,000 + $1,390,000)÷ 2 = $1,415,500

**Average stockholders' equity = ($902,000 + $890,000)÷ 2 = $896,000

d.Earnings per share = Net Income ÷ Average number of common shares outstanding*

= $15,000 ÷ 60,000 shares = $0.25 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $180,000 ÷ $3 per share = 60,000 shares

e.Price-earnings ratio = Market price per share ÷ Earnings per share

= $2.70 ÷ $0.25 = 10.80 (rounded)

f.Dividend payout ratio = Dividends per share* ÷ Earnings per share

= $0.05 ÷ $0.25 = 20.0% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $3,000 ÷ 60,000 shares = $0.05 per share (rounded)

g.Dividend yield ratio = Dividends per share* ÷ Market price per share

= $0.05 ÷ $2.70 = 1.85% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $3,000 ÷ 60,000 shares = $0.05 per share (rounded)

h.Book value per share = Common stockholders' equity ÷ Number of common shares outstanding*

= $902,000 ÷ 60,000 shares = $15.03 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $180,000 ÷ $3 per share = 60,000 shares

ZK

Answered

Supplemental wage payments include all the following except:

A) Commissions.

B) Expenses paid under an accountable plan.

C) Taxable fringe benefits.

D) Bonuses.

A) Commissions.

B) Expenses paid under an accountable plan.

C) Taxable fringe benefits.

D) Bonuses.

On Jul 04, 2024

B

ZK

Answered

Jack Roberts indorsed his paycheck "For Deposit to My Account No.4976463 at National Bank." In the meantime,he loses the check and Mary Green finds it.If Green tries to cash the check at a check-cashing service and it gives her the money,what is the result?

A) Roberts does not have any legal remedies.

B) National Bank will be liable to Roberts for converting his check.

C) Green will be liable to Roberts for converting his check.

D) The check-cashing service will be liable to Roberts for converting his check.

A) Roberts does not have any legal remedies.

B) National Bank will be liable to Roberts for converting his check.

C) Green will be liable to Roberts for converting his check.

D) The check-cashing service will be liable to Roberts for converting his check.

On Jun 07, 2024

D

ZK

Answered

Using the reciprocal services method, which of the following equations represents the algebraic expressions for the two equations needed to capture the total costs of a Janitorial Department (J) that includes not only $500,000 of direct costs but also 25% of the Maintenance Department (M) cost and the Maintenance Department that includes not only $450,000 of direct costs but also 30% of the Janitorial Department?

A) J = $500,000 + (0.25 ÷ M) and M = $450,000 + (0.30 ÷ J)

B) J = ($500,000 × 0.25) + M and M = ($450,000 × 0.20) + J

C) J = $500,000 - (0.25 × M) and M = $450,000 - (0.20 × J)

D) J = $500,000 + (0.25 × M) and M = $450,000 + (0.20 × J)

A) J = $500,000 + (0.25 ÷ M) and M = $450,000 + (0.30 ÷ J)

B) J = ($500,000 × 0.25) + M and M = ($450,000 × 0.20) + J

C) J = $500,000 - (0.25 × M) and M = $450,000 - (0.20 × J)

D) J = $500,000 + (0.25 × M) and M = $450,000 + (0.20 × J)

On Jun 04, 2024

D

ZK

Answered

Refer to Table 13-15. What is the shape of the average-total-cost curve?

On May 07, 2024

ATC = TC/Q, where TC is graphed on the vertical axis and Q (not labor) is graphed on the horizontal axis. For the range of output specified in the table, as output increases, ATC first decreases, then increases ($0.10, $0.06, $0.06, $0.06, $0.07, $0.08). ATC is U-shaped.

ZK

Answered

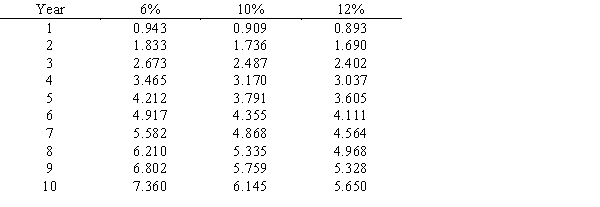

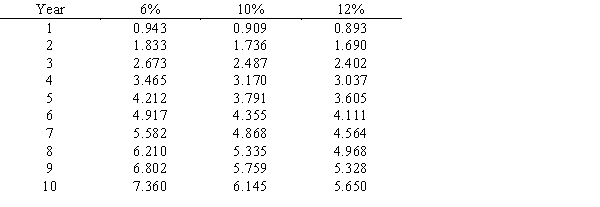

A project is estimated to cost $273,840 and provide annual net cash inflows of $60,000 for 7 years. Determine the internal rate of return for this project, using the following present value of an annuity table.

On May 04, 2024

12% [($273,840 ÷ $60,000) = 4.564, the present value of an annuity factor for 7 years at 12%]