ZK

Zybrea Knight

Answers (3)

ZK

Answered

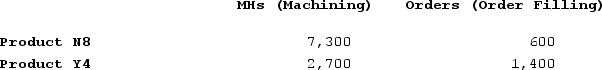

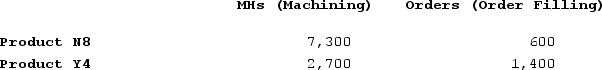

Dercole Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $43,200; Order Filling, $13,900; and Other, $14,900. Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product N8 under activity-based costing?

What is the overhead cost assigned to Product N8 under activity-based costing?

A) $4,170

B) $31,536

C) $35,706

D) $36,000

What is the overhead cost assigned to Product N8 under activity-based costing?

What is the overhead cost assigned to Product N8 under activity-based costing?A) $4,170

B) $31,536

C) $35,706

D) $36,000

On May 08, 2024

C

ZK

Answered

On March 25, Osgood Company sold merchandise on account, $10,000, terms n/30. The applicable sales tax percentage is 7.5%. Record the transaction. Journal Date Description Post. Ref. Debit Credit \begin{array}{l}\text { Journal }\\\begin{array} { | c | c | c | c | c | } \hline \text { Date } & \text { Description } & \begin{array} { c } \text { Post. } \\\text { Ref. }\end{array} & \text { Debit } & \text { Credit } \\\hline & & & & \\\hline & & & & \\\hline & & & & \\\hline\end{array}\end{array} Journal Date Description Post. Ref. Debit Credit

On May 08, 2024

Journal Date Description Post. Ref. Debit Credit Mar. 25 Accounts Receivable 10,750 Sales 10,000 Sales Tax Payable 750\begin{array}{l}\text { Journal }\\\begin{array} { | c | c | c | c | r | } \hline \text { Date } & \text { Description } & \begin{array} { c } \text { Post. } \\\text { Ref. }\end{array} & \text { Debit } & \text { Credit } \\\hline \text { Mar. 25 } & \text { Accounts Receivable } & & 10,750 & \\\hline & \text { Sales } & & & 10,000 \\\hline & \text { Sales Tax Payable } & & & 750 \\\hline\end{array}\end{array} Journal Date Mar. 25 Description Accounts Receivable Sales Sales Tax Payable Post. Ref. Debit 10,750 Credit 10,000750

ZK

Answered

Canadians have been the least active foreign whistle-blowers to the U.S.Securities and Exchange Commission Office of the Whistleblower.

On May 04, 2024

False