AF

alicia flores

Answers (6)

AF

Answered

A highly-paid research scientist works 12 hours a day, while a common laborer works only 5 hours a day. Offer a likely explanation, using the concept of opportunity cost.

On Jul 27, 2024

The wage (opportunity cost of leisure) is higher for the research scientist than for the common laborer, so the scientist takes less leisure than does the laborer.

AF

Answered

BullsNBears, a purveyor of financial databases, estimates it they disburses $440,000 monthly in order to pay bills. The firm's opportunity rate is 5%. The fixed cost of transferring money is $25 per transfer. Based on historical data, the standard deviation of monthly cash flows is $15,000 and the lower cash balance limit is $20,000. For Miller-Orr model questions, assume the interest rate is 0.5% per month. Using the BAT model, what is the optimal average cash balance?

A) $34,495

B) $36,332

C) $37,195

D) $45,619

E) $53,227

A) $34,495

B) $36,332

C) $37,195

D) $45,619

E) $53,227

On Jul 24, 2024

B

AF

Answered

All of the following should be considered in a make-or-buy decision except

A) cost savings

B) quality issues with the supplier

C) future growth in the plant and other production opportunities

D) whether the supplier will make a profit that would no longer belong to the business

A) cost savings

B) quality issues with the supplier

C) future growth in the plant and other production opportunities

D) whether the supplier will make a profit that would no longer belong to the business

On Jun 27, 2024

D

AF

Answered

During the current period, Ambrose Limited sold inventories to its parent entity at a profit of $12 000. The inventories cost Ambrose Limited $36 000. At balance sheet date the parent had sold 50% of the inventories to an external party. The consolidation adjustment entry (excluding tax effects) will eliminate unrealised profit amounting to:

A) $1 000.

B) $18 000.

C) $6 000.

D) $36 000.

A) $1 000.

B) $18 000.

C) $6 000.

D) $36 000.

On Jun 23, 2024

C

AF

Answered

By framing an issue as one of differences, interns can set themselves up for mutual understanding and compromise.

On May 28, 2024

True

AF

Answered

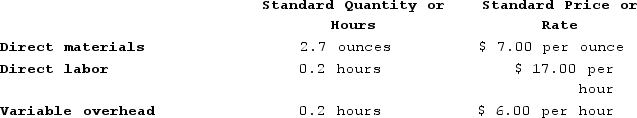

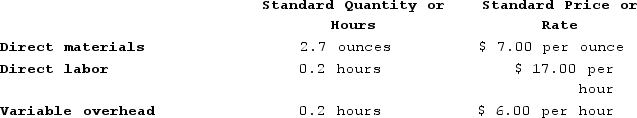

Doby Corporation makes a product with the following standard costs:

In July the company produced 4,800 units using 13,450 ounces of the direct material and 970 direct labor-hours. During the month the company purchased 14,600 ounces of the direct material at a price of $7.20 per ounce. The actual direct labor rate was $16.20 per hour and the actual variable overhead rate was $5.40 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

In July the company produced 4,800 units using 13,450 ounces of the direct material and 970 direct labor-hours. During the month the company purchased 14,600 ounces of the direct material at a price of $7.20 per ounce. The actual direct labor rate was $16.20 per hour and the actual variable overhead rate was $5.40 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

In July the company produced 4,800 units using 13,450 ounces of the direct material and 970 direct labor-hours. During the month the company purchased 14,600 ounces of the direct material at a price of $7.20 per ounce. The actual direct labor rate was $16.20 per hour and the actual variable overhead rate was $5.40 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

In July the company produced 4,800 units using 13,450 ounces of the direct material and 970 direct labor-hours. During the month the company purchased 14,600 ounces of the direct material at a price of $7.20 per ounce. The actual direct labor rate was $16.20 per hour and the actual variable overhead rate was $5.40 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

On May 24, 2024

a. Standard quantity = 4,800 units × 2.7 ounces per unit = 12,960 ounces

Materials quantity variance = (Actual quantity − Standard quantity) × Standard price

= (13,450 ounces − 12,960 ounces) × $7.00 per ounce

= (490 ounces) × $7.00 per ounce

= $3,430 Unfavorable

b. Materials price variance = Actual quantity × (Actual price − Standard price)

= 14,600 ounces × ($7.20 per ounce − $7.00 per ounce)

= 14,600 ounces × ($0.20 per ounce))

= $2,920 Unfavorable

c. Standard hours = 4,800 units × 0.2 hours per unit = 960 hours

Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

= (970 hours − 960 hours) × $17.00 per hour)

= (10 hours) × $17.00 per hour)

= $170 Unfavorable

d. Labor rate variance = Actual hours × (Actual rate − Standard rate)

= 970 hours × ($16.20 per hour − $17.00 per hour)

= 970 hours × (−$0.80 per hour)

= $776 Favorable

e. Standard hours = 4,800 units × 0.2 hours per unit = 960 hours

Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (970 hours − 960 hours) × $6.00 per hour

= (10 hours) × $6.00 per hour

= $60 Unfavorable

f. Variable overhead rate variance = Actual hours × (Actual rate − Standard rate)

= 970 hours × ($5.40 per hour − $6.00 per hour)

= 970 hours × (−$0.60 per hour)

= $582 Favorable

Materials quantity variance = (Actual quantity − Standard quantity) × Standard price

= (13,450 ounces − 12,960 ounces) × $7.00 per ounce

= (490 ounces) × $7.00 per ounce

= $3,430 Unfavorable

b. Materials price variance = Actual quantity × (Actual price − Standard price)

= 14,600 ounces × ($7.20 per ounce − $7.00 per ounce)

= 14,600 ounces × ($0.20 per ounce))

= $2,920 Unfavorable

c. Standard hours = 4,800 units × 0.2 hours per unit = 960 hours

Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

= (970 hours − 960 hours) × $17.00 per hour)

= (10 hours) × $17.00 per hour)

= $170 Unfavorable

d. Labor rate variance = Actual hours × (Actual rate − Standard rate)

= 970 hours × ($16.20 per hour − $17.00 per hour)

= 970 hours × (−$0.80 per hour)

= $776 Favorable

e. Standard hours = 4,800 units × 0.2 hours per unit = 960 hours

Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (970 hours − 960 hours) × $6.00 per hour

= (10 hours) × $6.00 per hour

= $60 Unfavorable

f. Variable overhead rate variance = Actual hours × (Actual rate − Standard rate)

= 970 hours × ($5.40 per hour − $6.00 per hour)

= 970 hours × (−$0.60 per hour)

= $582 Favorable