CG

corina guzman

Answers (6)

CG

Answered

Anchoring is more closely associated with which of the following factors?

A) Stereotypes that affect your decisions

B) Bias against higher prices

C) Suggestions that affect your final decision

D) Manipulation of consumer prices

A) Stereotypes that affect your decisions

B) Bias against higher prices

C) Suggestions that affect your final decision

D) Manipulation of consumer prices

On Jul 16, 2024

C

CG

Answered

Which of the following cash flows is not considered when using the net present value method?

A) Future cash inflows.

B) Future cash outflows.

C) Past cash outflows.

D) Non-uniform cash inflows.

E) Future year-end cash flows.

A) Future cash inflows.

B) Future cash outflows.

C) Past cash outflows.

D) Non-uniform cash inflows.

E) Future year-end cash flows.

On Jul 15, 2024

C

CG

Answered

The four-factor model used to construct performance benchmarks for mutual funds uses the three Fama and French factors and one additional factor related to ________.

A) the tenure of the fund manager

B) momentum

C) fees

D) the age of the fund manager

A) the tenure of the fund manager

B) momentum

C) fees

D) the age of the fund manager

On Jun 16, 2024

B

CG

Answered

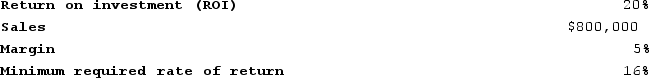

The following data pertains to Timmins Company's operations last year:

Required:

Required:

a. Compute the company's average operating assets.

b. Compute the company's residual income for the year.

Required:

Required:a. Compute the company's average operating assets.

b. Compute the company's residual income for the year.

On Jun 15, 2024

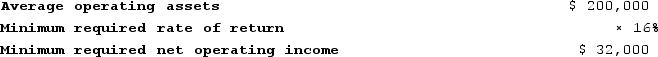

a. Return on investment = Margin × Turnover

20% = 5% × Turnover

Turnover = 20% ÷ 5% = 4

Turnover = Sales ÷ Average operating assets

4 = $800,000 ÷ Average operating assets

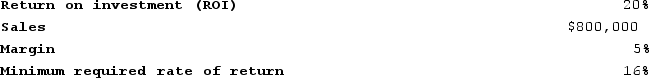

Average operating assets = $800,000 ÷ 4 = $200,000

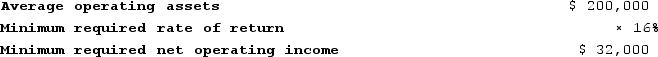

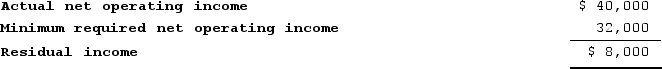

b. Before the residual income can be computed, we must first compute the company's net operating income for the year:

Margin = Net operating income ÷ Sales

5% = Net operating income ÷ $800,000

Net operating income = 5% × $800,000 = $40,000

20% = 5% × Turnover

Turnover = 20% ÷ 5% = 4

Turnover = Sales ÷ Average operating assets

4 = $800,000 ÷ Average operating assets

Average operating assets = $800,000 ÷ 4 = $200,000

b. Before the residual income can be computed, we must first compute the company's net operating income for the year:

Margin = Net operating income ÷ Sales

5% = Net operating income ÷ $800,000

Net operating income = 5% × $800,000 = $40,000

CG

Answered

The regional manager for your furniture store announces a goal of increasing the company's share of wallet by 10 percent. What does the manager mean?

On May 17, 2024

The manager wants to increase sales to the store's current customers, increasing the percentage of purchases a customer makes from that store rather than competitors' stores.

CG

Answered

Purely competitive industry X has constant costs and its product is an inferior good.The industry is currently in long-run equilibrium.The economy now goes into a recession and average incomes decline.The result will be:

A) an increase in output and in the price of the product.

B) an increase in output,but not in the price,of the product.

C) a decrease in the output,but not in the price,of the product.

D) a decrease in output and in the price of the product.

A) an increase in output and in the price of the product.

B) an increase in output,but not in the price,of the product.

C) a decrease in the output,but not in the price,of the product.

D) a decrease in output and in the price of the product.

On May 16, 2024

B