DB

destiny bravo

Answers (6)

DB

Answered

Followers who have strong needs for affiliation prefer which type of leadership behavior?

A) supportive

B) directive

C) participative

D) achievement oriented

A) supportive

B) directive

C) participative

D) achievement oriented

On Jul 16, 2024

A

DB

Answered

A product is currently made in a process-focused shop, where fixed costs are $10,500 per year and variable cost is $40 per unit. The firm sells the product for $190 per unit. What is the break-even point for this operation? What is the profit (or loss) on a demand of 300 units per year?

On Jul 15, 2024

BEP = 70 units; TR = $57,000, TC = $22,500, therefore Profit = $34,500.

DB

Answered

The effect of goals on performance is strongest when individuals have high goal commitment.

On Jun 16, 2024

True

DB

Answered

For the current year ending April 30, Hal Company expects fixed costs of $60,000, a unit variable cost of $70, and an anticipated break-even point of 1,715 sales units.

a.Compute the unit sales price.

b.Compute the sales (units) required to realize an operating profit of $8,000.Round your answer to the nearest whole number.

a.Compute the unit sales price.

b.Compute the sales (units) required to realize an operating profit of $8,000.Round your answer to the nearest whole number.

On Jun 15, 2024

a.$60,000 ÷ ($X - $70) = 1,715 units

X = $105

b.($60,000 + $8,000) ÷ ($105 - $70) = 1,943 units

X = $105

b.($60,000 + $8,000) ÷ ($105 - $70) = 1,943 units

DB

Answered

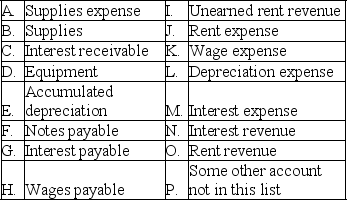

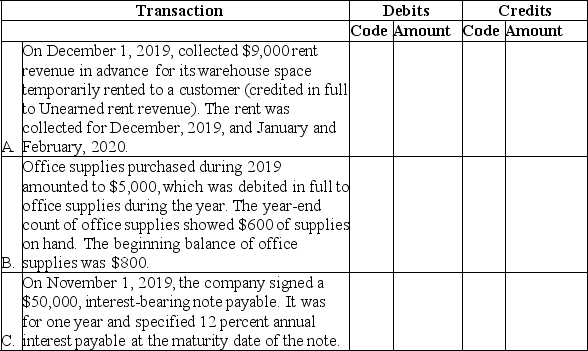

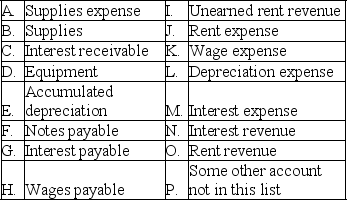

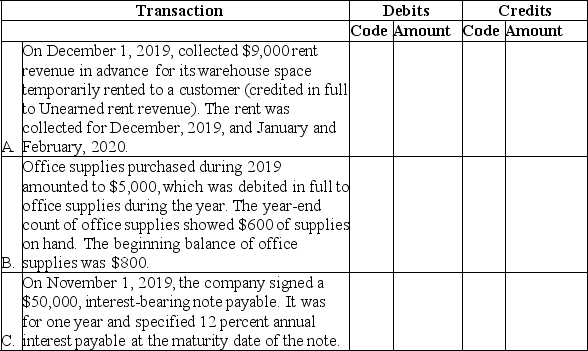

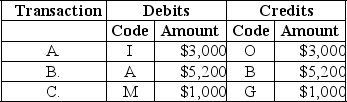

Center Company is completing the accounting cycle at the end of the annual accounting period,December 31,2019.Adjusting entries have not been made during the year so three adjusting entries must be made at this date to update the accounts.The following accounts,selected from Center Company's chart of accounts,are to be used for this purpose.They are coded to the left of each title for convenient reference.

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

On May 17, 2024

A.($9,000 × 1/3)= $3,000.

A.($9,000 × 1/3)= $3,000.B.($800 + 5,000 - 600)= $5,200.

C.($50,000 × 12% × 2/12)= $1,000.

DB

Answered

Negative reinforcement refers to a(n) ____ event that is ____ contingent upon the proper behavior.

A) unpleasant;removed

B) pleasant;removed

C) pleasant;added

D) unpleasant;added

A) unpleasant;removed

B) pleasant;removed

C) pleasant;added

D) unpleasant;added

On May 16, 2024

A