JG

jefeson garcia

Answers (8)

JG

Answered

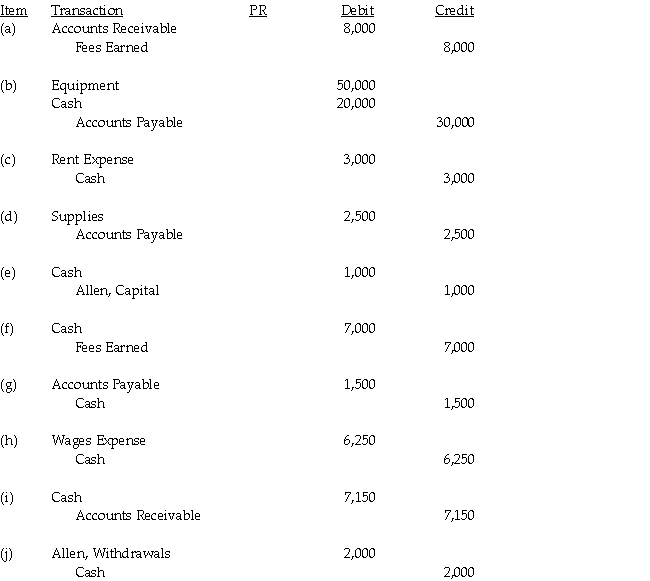

Record the following selected transactions for January in a two-column journal, identifying each entry by letter:

(a) Earned $8,000 fees; customer will pay later.

(b) Purchased equipment for $50,000, paying $20,000 in cash and the remainder on credit

(c) Paid $3,000 for rent for January.

(d) Purchased $2,500 of supplies on account.

(e) A. Allen $1,000 investment in the company.

(f) Received $7,000 in cash for fees earned previously.

(g) Paid $1,500 to creditors on account.

(h) Paid wages of $6,250.

(i) Received $7,150 from customers on account.

(j) A. Allen withdrawal of $2,000.

(a) Earned $8,000 fees; customer will pay later.

(b) Purchased equipment for $50,000, paying $20,000 in cash and the remainder on credit

(c) Paid $3,000 for rent for January.

(d) Purchased $2,500 of supplies on account.

(e) A. Allen $1,000 investment in the company.

(f) Received $7,000 in cash for fees earned previously.

(g) Paid $1,500 to creditors on account.

(h) Paid wages of $6,250.

(i) Received $7,150 from customers on account.

(j) A. Allen withdrawal of $2,000.

On Jul 30, 2024

JG

Answered

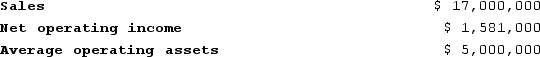

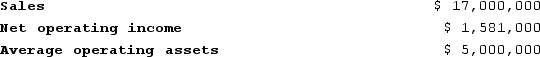

Agustin Industries is a division of a major corporation. Data concerning the most recent year appears below:  The division's return on investment (ROI) is closest to:

The division's return on investment (ROI) is closest to:

A) 24.0%

B) 31.62%

C) 3.0%

D) 9.3%

The division's return on investment (ROI) is closest to:

The division's return on investment (ROI) is closest to:A) 24.0%

B) 31.62%

C) 3.0%

D) 9.3%

On Jul 29, 2024

B

JG

Answered

For a company that has A$ as its functional currency, which of the following is not a foreign currency transaction?

A) goods sold at prices denominated in UK pounds

B) equipment sold at prices denominated in Japanese Yen.

C) inventory sold to a customer in Hong Kong who pays in A$.

D) borrowing funds where amounts are payable in NZ$.

A) goods sold at prices denominated in UK pounds

B) equipment sold at prices denominated in Japanese Yen.

C) inventory sold to a customer in Hong Kong who pays in A$.

D) borrowing funds where amounts are payable in NZ$.

On Jun 29, 2024

C

JG

Answered

When making a decision, a number of often-conflicting criteria representing the interests of different groups must be satisfied.

On Jun 26, 2024

True

JG

Answered

An debit balance in the direct material price variance account or direct labour price variance accounts would cause the costs of goods sold to

A) increase.

B) decrease.

C) stay the same.

D) have no impact.

A) increase.

B) decrease.

C) stay the same.

D) have no impact.

On Jun 25, 2024

A

JG

Answered

What is the purpose of Consolidation Entry A in a consolidation worksheet?

On May 27, 2024

Consolidation Entry A is a worksheet entry that removes the excess payment from the parent's Investment account and assigns that excess payment to the specific accounts indicated by the fair-value allocation. It also assists in eliminating the parent's Investment account balance on the consolidation worksheet.

JG

Answered

Brandy Corporation's trading portfolio at the end of the year is as follows: Security‾ Cost‾ Fair Value‾ Common Stock C $10,000$12,000 Common Stock D 8,000‾5,000‾$18,000‾$17,000‾\begin{array}{lrr}\underline{\text { Security}}&\underline{\text { Cost}}&\underline{\text { Fair Value}}\\\text { Common Stock C } & \$ 10,000 & \$ 12,000 \\\text { Common Stock D } & \underline{8,000} & \underline{5,000}\\&\underline{\$18,000}&\underline{\$17,000}\end{array} Security Common Stock C Common Stock D Cost$10,0008,000$18,000 Fair Value$12,0005,000$17,000

Brandy subsequently sells Stock D for $10000. What entry is made to record the sale? a.

Cash. 10,000 Stock Investments.10,000\begin{array}{llr} \text {Cash. } &10,000\\ \text { Stock Investments.} &&10,000\\\end{array}Cash. Stock Investments.10,00010,000

b.

Cash.10,000 Fair Value Adjustment-Trading 2,000Stock Investments. 8,000\begin{array}{llr} \text { Cash.} &10,000\\ \text { Fair Value Adjustment-Trading } &&2,000\\ \text {Stock Investments. } &&8,000\end{array} Cash. Fair Value Adjustment-Trading Stock Investments. 10,0002,0008,000

c.

Cash. 10,000 Stock Investments. 8,000 Gain on Sale of Stock Investments 2,000\begin{array}{llr} \text {Cash. } &10,000\\ \text { Stock Investments. } &&8,000\\ \text { Gain on Sale of Stock Investments } &&2,000\end{array}Cash. Stock Investments. Gain on Sale of Stock Investments 10,0008,0002,000

d.

Cash.10,000 Stock Investments. 5,000Gain on Sale of Stock Investments 5,000\begin{array}{llr} \text { Cash.} &10,000\\ \text { Stock Investments. } &&5,000\\ \text {Gain on Sale of Stock Investments } &&5,000\end{array} Cash. Stock Investments. Gain on Sale of Stock Investments 10,0005,0005,000

Brandy subsequently sells Stock D for $10000. What entry is made to record the sale? a.

Cash. 10,000 Stock Investments.10,000\begin{array}{llr} \text {Cash. } &10,000\\ \text { Stock Investments.} &&10,000\\\end{array}Cash. Stock Investments.10,00010,000

b.

Cash.10,000 Fair Value Adjustment-Trading 2,000Stock Investments. 8,000\begin{array}{llr} \text { Cash.} &10,000\\ \text { Fair Value Adjustment-Trading } &&2,000\\ \text {Stock Investments. } &&8,000\end{array} Cash. Fair Value Adjustment-Trading Stock Investments. 10,0002,0008,000

c.

Cash. 10,000 Stock Investments. 8,000 Gain on Sale of Stock Investments 2,000\begin{array}{llr} \text {Cash. } &10,000\\ \text { Stock Investments. } &&8,000\\ \text { Gain on Sale of Stock Investments } &&2,000\end{array}Cash. Stock Investments. Gain on Sale of Stock Investments 10,0008,0002,000

d.

Cash.10,000 Stock Investments. 5,000Gain on Sale of Stock Investments 5,000\begin{array}{llr} \text { Cash.} &10,000\\ \text { Stock Investments. } &&5,000\\ \text {Gain on Sale of Stock Investments } &&5,000\end{array} Cash. Stock Investments. Gain on Sale of Stock Investments 10,0005,0005,000

On May 26, 2024

C

JG

Answered

Haute Dogs Inc. sells a franchise to Ilene's Cuisine, a lunch truck. Ilene's Cuisine is

A) a franchisee.

B) a franchisor.

C) a partner.

D) a principal.

A) a franchisee.

B) a franchisor.

C) a partner.

D) a principal.

On May 25, 2024

A