JD

joseph donald

Answers (6)

JD

Answered

For a noncompetition clause to be enforceable,the clause must serve a legitimate business purpose.

On Jul 11, 2024

True

JD

Answered

Constance has been asked to approve a marketing campaign that promotes food products to children. She is concerned that the food products are not particularly nutritious, although they are not as bad as the products sold by competitors. The ethical decision-making metric will allow Constance to

A) brainstorm alternative food products to promote in the campaign.

B) consider the profit potential of approving the campaign.

C) assess the likelihood that parents will purchase the products for their children.

D) use a series of tests to evaluate alternative courses of action.

E) disregard personal ethical considerations in the decision-making process.

A) brainstorm alternative food products to promote in the campaign.

B) consider the profit potential of approving the campaign.

C) assess the likelihood that parents will purchase the products for their children.

D) use a series of tests to evaluate alternative courses of action.

E) disregard personal ethical considerations in the decision-making process.

On Jul 09, 2024

D

JD

Answered

Despite the obvious advantages of ABC, many firms are still reluctant to implement it. What are the reasons for this reluctance?

i. Uncertainty about the benefits of ABC.

ii. The opinion that the current system serves all the firm's needs.

iii. Lack of resources to implement ABC.

A) i and ii

B) ii and iii

C) i and iii

D) i, ii and iii

i. Uncertainty about the benefits of ABC.

ii. The opinion that the current system serves all the firm's needs.

iii. Lack of resources to implement ABC.

A) i and ii

B) ii and iii

C) i and iii

D) i, ii and iii

On Jun 11, 2024

D

JD

Answered

The three-step writing process is most effective in what type of business writing?

A) Emails

B) Short memos

C) Long reports

D) External communications

E) All written communications

A) Emails

B) Short memos

C) Long reports

D) External communications

E) All written communications

On Jun 09, 2024

E

JD

Answered

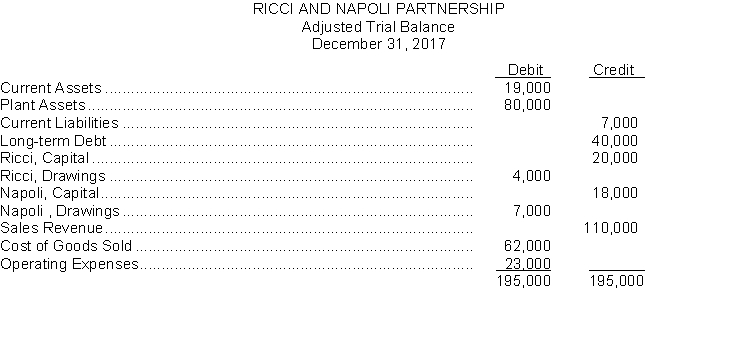

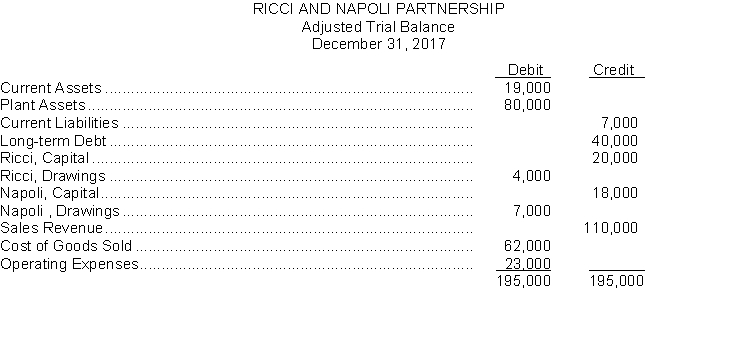

The adjusted trial balance of the Ricci and Napoli Partnership for the year ended December 31 2017 appears below:  The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

1. A salary allowance of $12000 to Ricci and $23000 to Napoli.

2. The remainder is to be divided equally.

Instructions

(a) Prepare a schedule which shows the division of net income to each partner.

(b) Prepare the closing entries for the division of net income and for the drawings accounts at December 31 2017.

The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:1. A salary allowance of $12000 to Ricci and $23000 to Napoli.

2. The remainder is to be divided equally.

Instructions

(a) Prepare a schedule which shows the division of net income to each partner.

(b) Prepare the closing entries for the division of net income and for the drawings accounts at December 31 2017.

On May 11, 2024

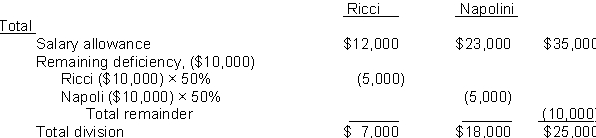

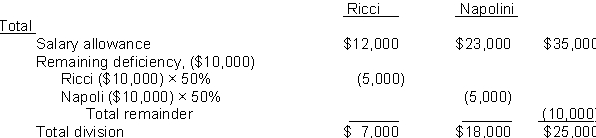

(a) Schedule for Division of Net Income Sales Revenue $110,000Cost of goods sold 62,000‾Gross profit 48,000Operating expenses 23,000‾ Net income $25,000\begin{array}{llr} \text { Schedule for Division of Net Income } &\\ \text {Sales Revenue } &\$110,000\\ \text {Cost of goods sold } &\underline{62,000}\\ \text {Gross profit } &48,000\\ \text {Operating expenses } &\underline{23,000}\\ \text { Net income } &\$25,000\\\end{array} Schedule for Division of Net Income Sales Revenue Cost of goods sold Gross profit Operating expenses Net income $110,00062,00048,00023,000$25,000

(b)

Dec. 31 Income Summary 25,000 Ricci, Capital 7,000Napoli, Capital 18,000 (To close net income to capital) 31 Ricci, Capital4,000 Napoli, Capital 7,000 Ricci, Drawings 4,000 Napoli, Drawings.7,000 (To close drawing accounts to capital) \begin{array}{llr} \text {Dec. 31 } &\text { Income Summary } &25,000\\& \text { Ricci, Capital } &&7,000\\& \text {Napoli, Capital } &&18,000\\ &\text { (To close net income to capital) } &\\\\31 & \text { Ricci, Capital} &4,000\\ &\text { Napoli, Capital } &7,000\\ &\text { Ricci, Drawings } &&4,000\\& \text { Napoli, Drawings.} &&7,000\\& \text { (To close drawing accounts to capital) } &\\\end{array}Dec. 31 31 Income Summary Ricci, Capital Napoli, Capital (To close net income to capital) Ricci, Capital Napoli, Capital Ricci, Drawings Napoli, Drawings. (To close drawing accounts to capital) 25,0004,0007,0007,00018,0004,0007,000

(b)

Dec. 31 Income Summary 25,000 Ricci, Capital 7,000Napoli, Capital 18,000 (To close net income to capital) 31 Ricci, Capital4,000 Napoli, Capital 7,000 Ricci, Drawings 4,000 Napoli, Drawings.7,000 (To close drawing accounts to capital) \begin{array}{llr} \text {Dec. 31 } &\text { Income Summary } &25,000\\& \text { Ricci, Capital } &&7,000\\& \text {Napoli, Capital } &&18,000\\ &\text { (To close net income to capital) } &\\\\31 & \text { Ricci, Capital} &4,000\\ &\text { Napoli, Capital } &7,000\\ &\text { Ricci, Drawings } &&4,000\\& \text { Napoli, Drawings.} &&7,000\\& \text { (To close drawing accounts to capital) } &\\\end{array}Dec. 31 31 Income Summary Ricci, Capital Napoli, Capital (To close net income to capital) Ricci, Capital Napoli, Capital Ricci, Drawings Napoli, Drawings. (To close drawing accounts to capital) 25,0004,0007,0007,00018,0004,0007,000

JD

Answered

Refer to Figure 2-9. Which of the following conclusions should not be drawn from observing this graph?

A) There is a positive correlation between the frequency of service and the number of passengers.

B) When there are five stops per hour, there are approximately 200 passengers.

C) More stops per hour is associated with more passengers per hour.

D) No other factors besides the frequency of service affect the number of passengers.

A) There is a positive correlation between the frequency of service and the number of passengers.

B) When there are five stops per hour, there are approximately 200 passengers.

C) More stops per hour is associated with more passengers per hour.

D) No other factors besides the frequency of service affect the number of passengers.

On May 10, 2024

D