MF

milan francisco

Answers (6)

MF

Answered

Describe why changing an organization's culture is so difficult and how change is possible.

On Jul 29, 2024

Changing a culture is difficult for at least three reasons.First,cultures give employees an organizational identity.It tells customers and others what the organization stands for.Second,culture provides stability.Third,culture helps focus its employees' behaviors.One of the functions of a culture is to help employees understand why the organization does what is does and how it intends to accomplish its long-term goals.

Successfully changing organizational culture requires understanding the old culture first because a new culture can't be developed unless managers and employees understand where they're starting from.It also requires providing support for employees and teams who have ideas for a better culture and are willing to act on those ideas.Finding the most effective subculture in the organization and using it as an example from which employees can learn can help change culture.Not attacking culture head on but finding ways to help employees and teams do their jobs more effectively is essential in changing culture as is treating the vision of a new culture as a guiding principle for change,not as a miracle cure.Other tips include recognizing that significant organization-wide cultural change takes 5 to 10 years;and living the new culture because actions speak louder than words.

Successfully changing organizational culture requires understanding the old culture first because a new culture can't be developed unless managers and employees understand where they're starting from.It also requires providing support for employees and teams who have ideas for a better culture and are willing to act on those ideas.Finding the most effective subculture in the organization and using it as an example from which employees can learn can help change culture.Not attacking culture head on but finding ways to help employees and teams do their jobs more effectively is essential in changing culture as is treating the vision of a new culture as a guiding principle for change,not as a miracle cure.Other tips include recognizing that significant organization-wide cultural change takes 5 to 10 years;and living the new culture because actions speak louder than words.

MF

Answered

The actions of buyers and sellers naturally move markets toward equilibrium.

On Jul 26, 2024

True

MF

Answered

Investment in Musical Acts

Signing new music acts can be highly speculative.Record producers at music studios have to get budget approval before they sign a new act to a recording deal.Most acts perform a tried and true form of popular music in which record sales can be pretty well predicted.However,once they get approval for their budgets,why do producers sometimes sign riskier acts who either flop or "break-out" into the next sensation?

Signing new music acts can be highly speculative.Record producers at music studios have to get budget approval before they sign a new act to a recording deal.Most acts perform a tried and true form of popular music in which record sales can be pretty well predicted.However,once they get approval for their budgets,why do producers sometimes sign riskier acts who either flop or "break-out" into the next sensation?

On Jun 29, 2024

This is a moral hazard issue.Record producers are investing other people's money and so have an incentive to switch to riskier investments once the funding has been secured.If the risky act flops,the company loses the money.If it succeeds,they get credit for discovering the new sound.

MF

Answered

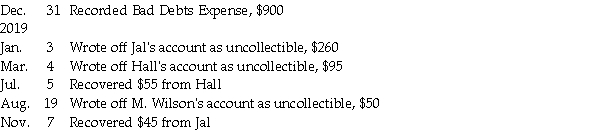

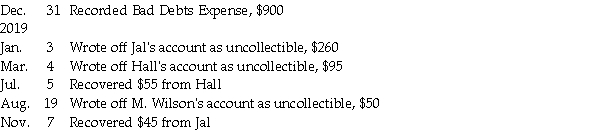

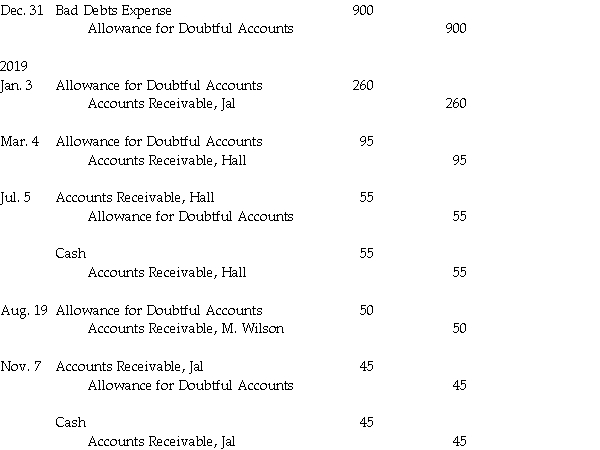

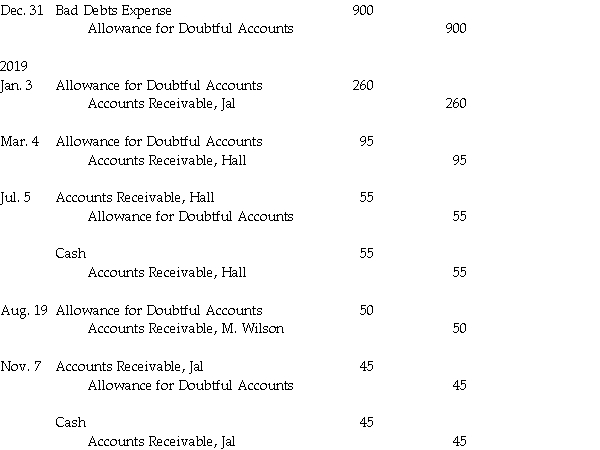

Prepare general journal entries to record the following transactions for the Smith Company. (The company uses the balance sheet approach for recording bad debts expense.)

2018

2018

On Jun 26, 2024

2018

MF

Answered

(a) The aging of Torme Designs' accounts receivable is shown below. Calculate the amount of each periodicity range that is deemed to be uncollectible.?? Estimated Uncollectible Accounts Age Interval Balance Percentage Amount Not past due $850,0003.50%1−30 days past due 47,5005.0031−60 days past due 21,75010.0061−90 days past due 11,25020.0091−180 days past due 5,06530.00181−365 days past due 2,50050.00 Over 365 days past due 1,145‾95.00 Total $939,210‾~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~{ \text { Estimated Uncollectible Accounts } } \\\begin{array} { | l | r | c | c | } \hline \text { Age Interval } & \text { Balance } & \text { Percentage } & \text { Amount } \\\hline \text { Not past due } & \$ 850,000 & 3.50 \% & \\\hline 1 - 30 \text { days past due } & 47,500 & 5.00 & \\\hline 31 - 60 \text { days past due } & 21,750 & 10.00 & \\\hline 61 - 90 \text { days past due } & 11,250 & 20.00 & \\\hline 91 - 180 \text { days past due } & 5,065 & 30.00 & \\\hline 181 - 365 \text { days past due } & 2,500 & 50.00 & \\\hline \text { Over } 365 \text { days past due } & \underline{1,145} & 95.00 & \\\hline \text { Total } & \underline{\mathbf { \$939,210 }} & & \\\hline\end{array} Estimated Uncollectible Accounts Age Interval Not past due 1−30 days past due 31−60 days past due 61−90 days past due 91−180 days past due 181−365 days past due Over 365 days past due Total Balance $850,00047,50021,75011,2505,0652,5001,145$939,210 Percentage 3.50%5.0010.0020.0030.0050.0095.00 Amount (b) If Allowance for Doubtful Accounts has a credit balance of $1,135.00, record the adjusting entry forthe bad debt expense for the year.

On May 30, 2024

(a) Estimated Uncollectible Accounts \text { (a) } \quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad { \text { Estimated Uncollectible } } \\\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad\quad { \text { Accounts } } (a) Estimated Uncollectible Accounts

Age Interval Balance Percentage Amount Not past due $850,0003.50%$29,750.001−30 days past due 47,5005.002,375.0031−60 days past due 21,75010.002,175.0061−90 days past due 11,25020.002,250.0091−180 days past due 5,06530.001,519.50181−365 days past due 2,50050.001,250.00 Over 365 days past due 1,145‾95.001,087.75‾ Total: $939,210‾$40,407.25‾\begin{array} { | l | r | c | r | } \hline \text { Age Interval } & \text { Balance } & \text { Percentage } & \text { Amount } \\\hline \text { Not past due } & \$ 850,000 & 3.50 \% & \$ 29,750.00 \\\hline 1 - 30 \text { days past due } & 47,500 & 5.00 & 2,375.00 \\\hline 31 - 60 \text { days past due } & 21,750 & 10.00 & 2,175.00 \\\hline 61 - 90 \text { days past due } & 11,250 & 20.00 & 2,250.00 \\\hline 91 - 180 \text { days past due } & 5,065 & 30.00 & 1,519.50 \\\hline 181 - 365 \text { days past due } & 2,500 & 50.00 & 1,250.00 \\\hline \text { Over } 365 \text { days past due } & \underline{1,145} & 95.00 & \underline{1,087.75} \\\hline \text { Total: } & \underline{\mathbf { \$ 9 3 9 , 2 1 0 }} & & \underline{\mathbf { \$ 4 0 , 4 0 7 . 2 5 }} \\\hline\end{array} Age Interval Not past due 1−30 days past due 31−60 days past due 61−90 days past due 91−180 days past due 181−365 days past due Over 365 days past due Total: Balance $850,00047,50021,75011,2505,0652,5001,145$939,210 Percentage 3.50%5.0010.0020.0030.0050.0095.00 Amount $29,750.002,375.002,175.002,250.001,519.501,250.001,087.75$40,407.25

(b)Dec. 31 Bad Debt Expense ~~~~~~~~~~~~ 39.272.25

Allowance for Doubtful Accounts ~~~~~~~~~~~~ 39.272.25

Calculation of expense:

Amount of calculated uncollectible accounts $40,407.25

Less credit balance of account 1,135.00‾~~~~~~~~~~~~~~~~~~~\underline {1,135.00} 1,135.00

Bad debt expense $ 39.272 .25 ‾~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~\underline { \textbf{\$ 39.272 .25 }} $ 39.272 .25

Age Interval Balance Percentage Amount Not past due $850,0003.50%$29,750.001−30 days past due 47,5005.002,375.0031−60 days past due 21,75010.002,175.0061−90 days past due 11,25020.002,250.0091−180 days past due 5,06530.001,519.50181−365 days past due 2,50050.001,250.00 Over 365 days past due 1,145‾95.001,087.75‾ Total: $939,210‾$40,407.25‾\begin{array} { | l | r | c | r | } \hline \text { Age Interval } & \text { Balance } & \text { Percentage } & \text { Amount } \\\hline \text { Not past due } & \$ 850,000 & 3.50 \% & \$ 29,750.00 \\\hline 1 - 30 \text { days past due } & 47,500 & 5.00 & 2,375.00 \\\hline 31 - 60 \text { days past due } & 21,750 & 10.00 & 2,175.00 \\\hline 61 - 90 \text { days past due } & 11,250 & 20.00 & 2,250.00 \\\hline 91 - 180 \text { days past due } & 5,065 & 30.00 & 1,519.50 \\\hline 181 - 365 \text { days past due } & 2,500 & 50.00 & 1,250.00 \\\hline \text { Over } 365 \text { days past due } & \underline{1,145} & 95.00 & \underline{1,087.75} \\\hline \text { Total: } & \underline{\mathbf { \$ 9 3 9 , 2 1 0 }} & & \underline{\mathbf { \$ 4 0 , 4 0 7 . 2 5 }} \\\hline\end{array} Age Interval Not past due 1−30 days past due 31−60 days past due 61−90 days past due 91−180 days past due 181−365 days past due Over 365 days past due Total: Balance $850,00047,50021,75011,2505,0652,5001,145$939,210 Percentage 3.50%5.0010.0020.0030.0050.0095.00 Amount $29,750.002,375.002,175.002,250.001,519.501,250.001,087.75$40,407.25

(b)Dec. 31 Bad Debt Expense ~~~~~~~~~~~~ 39.272.25

Allowance for Doubtful Accounts ~~~~~~~~~~~~ 39.272.25

Calculation of expense:

Amount of calculated uncollectible accounts $40,407.25

Less credit balance of account 1,135.00‾~~~~~~~~~~~~~~~~~~~\underline {1,135.00} 1,135.00

Bad debt expense $ 39.272 .25 ‾~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~\underline { \textbf{\$ 39.272 .25 }} $ 39.272 .25

MF

Answered

Cost of capital calculations assume that capital is usually raised:

A) in the proportions of either the target or the existing capital structure.

B) by selling as much as possible of one security at a time.

C) in the proportions of the existing capital structure.

D) in the proportions of the target capital structure.

A) in the proportions of either the target or the existing capital structure.

B) by selling as much as possible of one security at a time.

C) in the proportions of the existing capital structure.

D) in the proportions of the target capital structure.

On May 27, 2024

A