Asked by Kirstyn Alston on Apr 24, 2024

Verified

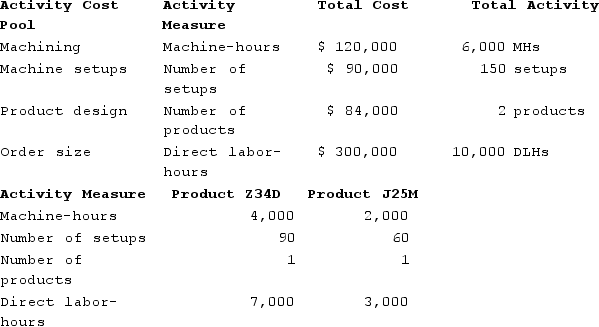

Orear Corporation manufactures two products: Product Z34D and Product J25M. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Z34D and J25M.  Using the plantwide overhead rate, the percentage of the total overhead cost that is allocated to Product J25M is closest to:

Using the plantwide overhead rate, the percentage of the total overhead cost that is allocated to Product J25M is closest to:

A) 50.00%

B) 30.00%

C) 15.15%

D) 19.87%

Plantwide Overhead Rate

A single overhead absorption rate used throughout a manufacturing facility to allocate overhead costs to products.

Activity-based Costing

A costing method that identifies the activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.

- Gain an understanding of how to compute activity rates in an Activity-Based Costing system.

- Fathom the ramifications of adopting ABC for product costing against the backdrop of classical costing approaches.

Verified Answer

BF

benjamin farquharson7 days ago

Final Answer :

B

Explanation :

Using the plantwide overhead rate, total overhead cost = $630,000

Direct labor-hours for Product Z34D = 4,000

Direct labor-hours for Product J25M = 6,000

Plantwide overhead rate = $630,000 / (4,000 + 6,000) = $63 per direct labor-hour

Overhead cost allocated to Product J25M = 6,000 x $63 = $378,000

To use ABC, we need to allocate the overhead to four cost pools - setup, machining, assembly, and inspection - based on the activities that drive the overhead costs.

The table below shows the overhead cost and activity information for each cost pool:

Cost Pool Overhead Cost Setup Hours Machining Hours Assembly Hours Inspection Hours

Setup $120,000 200 - - -

Machining $300,000 - 20,000 - -

Assembly $150,000 - - 10,000 -

Inspection $60,000 - - - 2,000

Total $630,000 200 20,000 10,000 2,000

To allocate the overhead cost to each product, we need to determine how much of each activity is required to produce one unit of each product. The table below shows the activity requirements for each product:

Product Setup Hours Machining Hours Assembly Hours Inspection Hours

Z34D 1 5 2 0.5

J25M 2 1 1 1.5

Using these activity requirements and the cost pool information, we can calculate the overhead cost for each product as follows:

Product Z34D:

Setup cost = 1 x $120,000 / 200 = $600

Machining cost = 5 x $300,000 / 20,000 = $7,500

Assembly cost = 2 x $150,000 / 10,000 = $3,000

Inspection cost = 0.5 x $60,000 / 2,000 = $1,500

Total overhead cost for Z34D = $12,600

Product J25M:

Setup cost = 2 x $120,000 / 200 = $1,200

Machining cost = 1 x $300,000 / 20,000 = $15

Assembly cost = 1 x $150,000 / 10,000 = $15

Inspection cost = 1.5 x $60,000 / 2,000 = $45

Total overhead cost for J25M = $1,275

Therefore, the percentage of the total overhead cost that is allocated to Product J25M using ABC is:

Total overhead cost for J25M / Total overhead cost = $1,275 / $630,000 = 0.2024 or 20.24%

The percentage is closest to choice B (30.00%).

Direct labor-hours for Product Z34D = 4,000

Direct labor-hours for Product J25M = 6,000

Plantwide overhead rate = $630,000 / (4,000 + 6,000) = $63 per direct labor-hour

Overhead cost allocated to Product J25M = 6,000 x $63 = $378,000

To use ABC, we need to allocate the overhead to four cost pools - setup, machining, assembly, and inspection - based on the activities that drive the overhead costs.

The table below shows the overhead cost and activity information for each cost pool:

Cost Pool Overhead Cost Setup Hours Machining Hours Assembly Hours Inspection Hours

Setup $120,000 200 - - -

Machining $300,000 - 20,000 - -

Assembly $150,000 - - 10,000 -

Inspection $60,000 - - - 2,000

Total $630,000 200 20,000 10,000 2,000

To allocate the overhead cost to each product, we need to determine how much of each activity is required to produce one unit of each product. The table below shows the activity requirements for each product:

Product Setup Hours Machining Hours Assembly Hours Inspection Hours

Z34D 1 5 2 0.5

J25M 2 1 1 1.5

Using these activity requirements and the cost pool information, we can calculate the overhead cost for each product as follows:

Product Z34D:

Setup cost = 1 x $120,000 / 200 = $600

Machining cost = 5 x $300,000 / 20,000 = $7,500

Assembly cost = 2 x $150,000 / 10,000 = $3,000

Inspection cost = 0.5 x $60,000 / 2,000 = $1,500

Total overhead cost for Z34D = $12,600

Product J25M:

Setup cost = 2 x $120,000 / 200 = $1,200

Machining cost = 1 x $300,000 / 20,000 = $15

Assembly cost = 1 x $150,000 / 10,000 = $15

Inspection cost = 1.5 x $60,000 / 2,000 = $45

Total overhead cost for J25M = $1,275

Therefore, the percentage of the total overhead cost that is allocated to Product J25M using ABC is:

Total overhead cost for J25M / Total overhead cost = $1,275 / $630,000 = 0.2024 or 20.24%

The percentage is closest to choice B (30.00%).

Learning Objectives

- Gain an understanding of how to compute activity rates in an Activity-Based Costing system.

- Fathom the ramifications of adopting ABC for product costing against the backdrop of classical costing approaches.