Asked by Billy Yeung on Apr 25, 2024

Verified

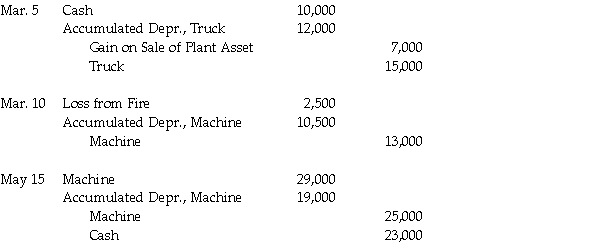

Journalize the following transactions for Pets R Us:

Mar. 5 Sold a truck for $10,000 that cost $15,000 and had an accumulated depreciation of $12,000.

Mar. 10 A machine costing $13,000 with accumulated depreciation of $10,500 was destroyed in a fire. No claim was filed.

May 15 Traded in a machine costing $25,000, with $19,000 of accumulated depreciation, for a new machine costing $32,000 with a trade-in allowance of$ 9,000.

Accumulated Depreciation

The total depreciation for a fixed asset that has been charged to expense since the asset was acquired and made available for use.

Trade-in Allowance

The amount credited to a buyer by a seller for the property or goods being part-exchanged.

- Acquire knowledge on how to prepare journal entries for the disposal of fixed assets and comprehend their impact on financial statements.

- Grasp the regulatory framework governing trade-ins of assets and its repercussions on the cost basis of the new asset.

Verified Answer

JC

Learning Objectives

- Acquire knowledge on how to prepare journal entries for the disposal of fixed assets and comprehend their impact on financial statements.

- Grasp the regulatory framework governing trade-ins of assets and its repercussions on the cost basis of the new asset.

Related questions

The Cutcut Mower Service Owned a Truck with an Original ...

Ken Alberts Owned Equipment with an Original Cost of $45,000 ...

Hello Online Disposed of a Van That Cost $26,000 with ...

A Computer Server System, Which Had Cost $250,000 and Had ...

A Computer Server System, Which Had Cost $250,000 and Had ...