Asked by Chih-Hsiang Chang on Apr 25, 2024

Verified

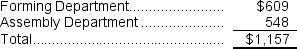

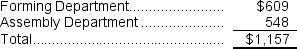

The total amount of overhead applied in both departments to Job T924 is closest to:

A) $1,157

B) $548

C) $609

D) $1,705

Overhead Applied

The portion of estimated overhead costs allocated to individual products or job orders based on a predetermined rate or method.

Departments

Organizational units within a company, each specializing in a particular area of operation.

- Develop proficiency in the application of predetermined overhead rates specific to departments, with an allocation base of machine-hours.

Verified Answer

NP

Nikhil Patel8 days ago

Final Answer :

A

Explanation :

Forming Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per machine-hour × Total machine-hours in the department)

= $102,400 + ($2.30 per machine-hour × 16,000 machine-hours)

= $102,400 +$36,800 = $139,200

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base incurred = $139,200 ÷ 16,000 machine-hours = $8.70 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $8.70 per machine-hour × 70 machine-hours = $609

Assembly Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $55,200 + ($4.50 per direct labor-hour × 6,000 direct labor-hours)

= $55,200 + $27,000 = $82,200

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base incurred = $82,200 ÷6,000 direct labor-hours = $13.70 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $13.70 per direct labor-hour × 40 direct labor-hours = $548

Overhead applied to Job T924 Reference: CH02-Ref40

Reference: CH02-Ref40

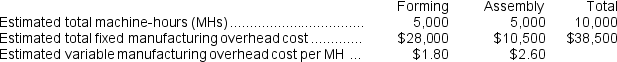

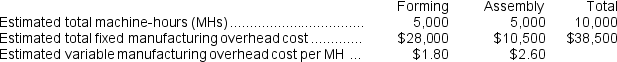

Merati Corporation has two manufacturing departments--Forming and Assembly.The company used the following data at the beginning of the year to calculate predetermined overhead rates: During the most recent month, the company started and completed two jobs--Job B and Job L.There were no beginning inventories.Data concerning those two jobs follow:

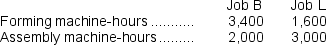

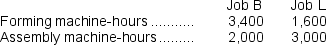

During the most recent month, the company started and completed two jobs--Job B and Job L.There were no beginning inventories.Data concerning those two jobs follow:

= $102,400 + ($2.30 per machine-hour × 16,000 machine-hours)

= $102,400 +$36,800 = $139,200

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base incurred = $139,200 ÷ 16,000 machine-hours = $8.70 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $8.70 per machine-hour × 70 machine-hours = $609

Assembly Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $55,200 + ($4.50 per direct labor-hour × 6,000 direct labor-hours)

= $55,200 + $27,000 = $82,200

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base incurred = $82,200 ÷6,000 direct labor-hours = $13.70 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $13.70 per direct labor-hour × 40 direct labor-hours = $548

Overhead applied to Job T924

Reference: CH02-Ref40

Reference: CH02-Ref40Merati Corporation has two manufacturing departments--Forming and Assembly.The company used the following data at the beginning of the year to calculate predetermined overhead rates:

During the most recent month, the company started and completed two jobs--Job B and Job L.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job L.There were no beginning inventories.Data concerning those two jobs follow:

Learning Objectives

- Develop proficiency in the application of predetermined overhead rates specific to departments, with an allocation base of machine-hours.

Related questions

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

The Predetermined Overhead Rate for the Casting Department Is Closest ...

Henkes Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

The Predetermined Overhead Rate for the Customizing Department Is Closest ...