Asked by Scott Nguyen on Jul 03, 2024

Verified

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices.The calculated selling price for Job C is closest to:

A) $87,666

B) $68,920

C) $13,784

D) $82,704

Departmental Predetermined Overhead Rates

Rates calculated in advance for each department, used to assign overhead costs based on estimated activity levels.

Machine-Hours

A measure of the total time that machines are operating, often used as a basis for allocating manufacturing overhead costs.

Markup

The amount added to the cost price of goods to cover overhead and profit, resulting in the selling price.

- Become adept at determining selling prices by adding markups to the expenses incurred in manufacturing.

- Achieve command over the application of overhead through the use of predetermined department-specific rates, with machine-hours as the allocation criterion.

- Gain insights into the relationship between manufacturing overhead and selling prices.

Verified Answer

Direct materials: $10,000

Direct labor: 200 hours x $12 per hour = $2,400

Manufacturing overhead:

Machine-hours in Department A = 750 hours

Department A predetermined overhead rate = $30 per machine-hour

Department A manufacturing overhead = 750 x $30 = $22,500

Machine-hours in Department B = 1,500 hours

Department B predetermined overhead rate = $20 per machine-hour

Department B manufacturing overhead = 1,500 x $20 = $30,000

Total manufacturing overhead = $22,500 + $30,000 = $52,500

Total manufacturing cost = $10,000 + $2,400 + $52,500 = $65,900

Markup of 20% on manufacturing cost = 20% x $65,900 = $13,180

Selling price = $65,900 + $13,180 = $79,080

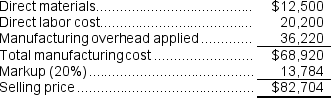

Therefore, the closest calculated selling price for Job C is D) $82,704.

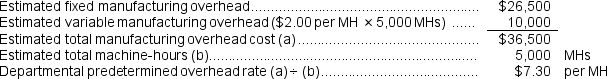

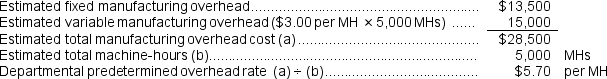

Finishing Department predetermined overhead rate:

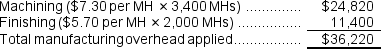

Finishing Department predetermined overhead rate:  Manufacturing overhead applied to Job C:

Manufacturing overhead applied to Job C:  The selling price for Job C would be calculated as follows:

The selling price for Job C would be calculated as follows:  Reference: CH02-Ref33

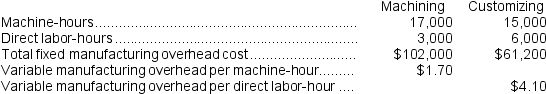

Reference: CH02-Ref33Collini Corporation has two production departments, Machining and Customizing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates:

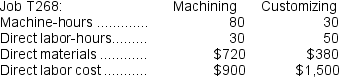

During the current month the company started and finished Job T268.The following data were recorded for this job:

During the current month the company started and finished Job T268.The following data were recorded for this job:

Learning Objectives

- Become adept at determining selling prices by adding markups to the expenses incurred in manufacturing.

- Achieve command over the application of overhead through the use of predetermined department-specific rates, with machine-hours as the allocation criterion.

- Gain insights into the relationship between manufacturing overhead and selling prices.

Related questions

If the Company Marks Up Its Manufacturing Costs by 20 ...

The Total Amount of Overhead Applied in Both Departments to ...

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

Lupo Corporation Uses a Job-Order Costing System with a Single ...

Opunui Corporation Has Two Manufacturing Departments--Molding and Finishing ...