Asked by giannah alessandra on Apr 27, 2024

Verified

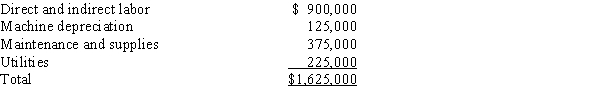

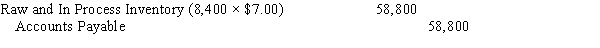

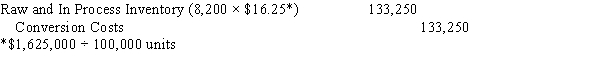

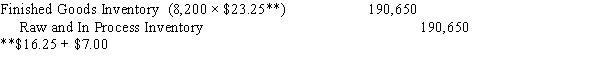

Kwanika Co. operates in a lean manufacturing environment. During its first year of operations, Kwanika budgeted for 40,000 hours in the production of 100,000 units in its Cell X-22. Materials costs were $7.00 per unit. Cell X-22 conversion costs were budgeted for the year as follows:  During January, materials for 8,400 units were purchased on account. There were 8,200 units manufactured and 8,000 were sold and shipped to customers for $35 each. Conversion costs are applied based on units of production. Journalize (a) the materials purchases, (b) the application of conversion costs, (c) the transfer from work in process to finished goods, and (d) the sales (all made on account) and associated cost of goods sold for the month of January.

During January, materials for 8,400 units were purchased on account. There were 8,200 units manufactured and 8,000 were sold and shipped to customers for $35 each. Conversion costs are applied based on units of production. Journalize (a) the materials purchases, (b) the application of conversion costs, (c) the transfer from work in process to finished goods, and (d) the sales (all made on account) and associated cost of goods sold for the month of January.

Lean Manufacturing

A planned procedure for cutting down on waste in manufacturing operations without negatively affecting productivity.

Conversion Costs

The combined costs of direct labor and overhead expenses incurred to convert materials into finished goods.

Work in Process

Inventory that includes all materials, labor, and overhead costs for products in the production process but not yet completed.

- Journalize transactions involving materials purchases, conversion costs applications, transfers to finished goods, and sales including associated cost of goods sold.

Verified Answer

Learning Objectives

- Journalize transactions involving materials purchases, conversion costs applications, transfers to finished goods, and sales including associated cost of goods sold.

Related questions

Journalize the Following Transactions for Both Abbott Co ...

Journalize the Following Transactions for the Evans Company ...

Marshall Supplies Is a Janitorial Supply Store That Uses a ...

Journalize the Following Transactions Assuming the Perpetual Inventory System ...

A Selected List of Accounts Used by Cline Manufacturing Company ...

b.

b.  c.

c.  d.

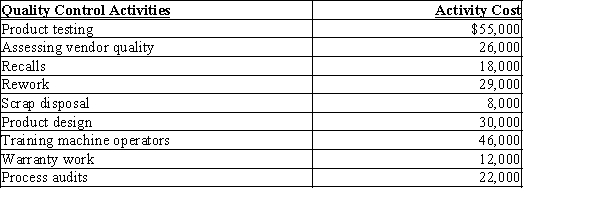

d.  Schedule of Activity Costs

Schedule of Activity Costs