Asked by Hannah Turner on Apr 27, 2024

Verified

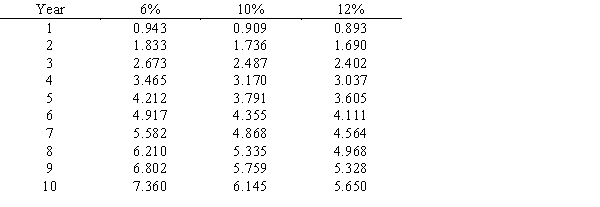

A project is estimated to cost $273,840 and provide annual net cash inflows of $60,000 for 7 years. Determine the internal rate of return for this project, using the following present value of an annuity table.

Present Value of Annuity

The current worth of a stream of equal payments made at regular intervals, discounted at a specific interest rate.

- Determine the internal rate of return for investment proposals.

Verified Answer

ZK

Zybrea KnightMay 04, 2024

Final Answer :

12% [($273,840 ÷ $60,000) = 4.564, the present value of an annuity factor for 7 years at 12%]

Learning Objectives

- Determine the internal rate of return for investment proposals.

Related questions

Norton Company Is Considering a Closed-Loop Geothermal Heat Pump to ...

Motel Corporation Is Analyzing a Capital Expenditure That Will Involve ...

The Anticipated Purchase of a Fixed Asset for $400,000, with ...

Norman Is Planning for His Retirement ...

The First National Bank Has Agreed to Lend You $30,000 ...