Asked by jayden pineda on Apr 29, 2024

Verified

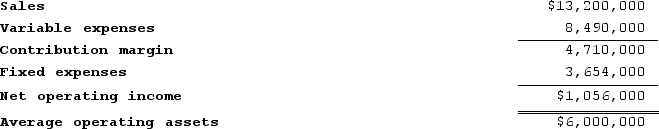

Worley Incorporated reported the following results from last year's operations:

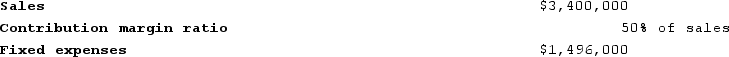

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

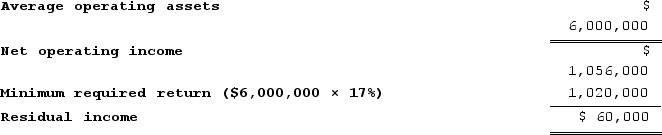

The company's minimum required rate of return is 17%.

The company's minimum required rate of return is 17%.

Required:

1. What was last year's residual income?

2. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

3. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

Residual Income

The income that an individual or business has after all expenses and costs, including capital costs, have been subtracted.

Investment Opportunity

A potential financial venture, project, or mechanism expected to yield returns or benefits.

Required Rate of Return

The minimum yearly return percentage required to attract individual or corporate investors to a specific security or project.

- Calculate residual income and understand its implications for investment decisions.

- Assess the return on investment (ROI) for new investment opportunities and their impact on overall company performance.

Verified Answer

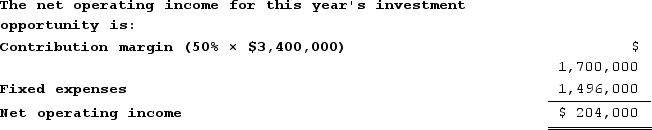

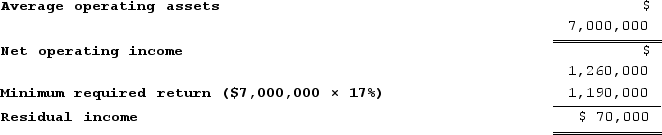

2. If the company pursues the investment opportunity, this year's residual income will be:

Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

Net operating income = $1,056,000 + $204,000 = $1,260,000

3. The chief executive officer would pursue the investment opportunity because residual income would increase by $34,000.

Learning Objectives

- Calculate residual income and understand its implications for investment decisions.

- Assess the return on investment (ROI) for new investment opportunities and their impact on overall company performance.

Related questions

Willing Incorporated Reported the Following Results from Last Year's Operations ...

The Casket Division of Saal Corporation Had Average Operating Assets ...

Craycraft Incorporated Reported the Following Results from Last Year's Operations ...

Ranallo Incorporated Reported the Following Results from Last Year's Operations ...

Familia Incorporated Reported the Following Results from Last Year's Operations ...