Asked by shelby nickella on Apr 29, 2024

Verified

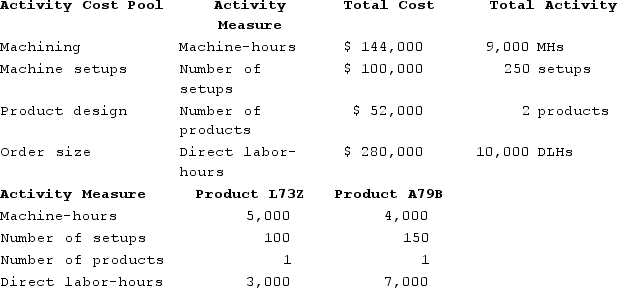

Losser Corporation manufactures two products: Product L73Z and Product A79B. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products L73Z and A79B.

Required:a. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product L73Z?b. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product A79B?c. Using theABC system, how much total manufacturing overhead cost would be assigned to Product A79B?d. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product L73Z?

Required:a. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product L73Z?b. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product A79B?c. Using theABC system, how much total manufacturing overhead cost would be assigned to Product A79B?d. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product L73Z?

Plantwide Overhead Rate

A single overhead rate calculated for an entire manufacturing plant, used to allocate indirect costs to products based on a common base such as labor hours or machine hours.

Activity-Based Costing

A cost accounting method that assigns costs to products or services based on the activities that go into producing them.

Manufacturing Overhead

Expenses related to the production process that are not directly tied to a specific product, including utilities, depreciation, and maintenance of equipment.

- Evaluate the assignment of manufacturing overhead expenses utilizing plantwide and activity-based costing methods.

Verified Answer

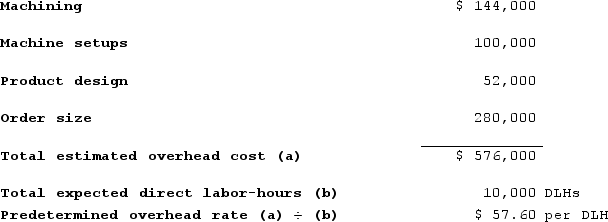

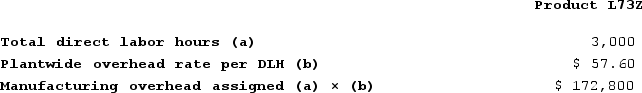

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product L73Z is computed as follows:

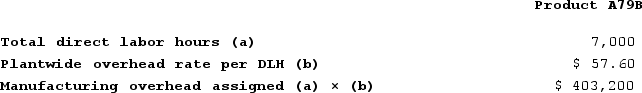

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product L73Z is computed as follows: Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product A79B is computed as follows:

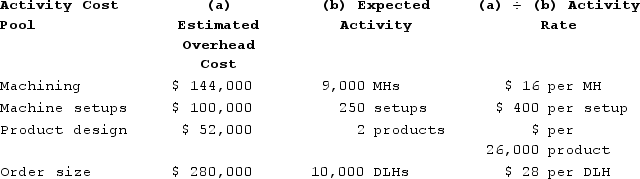

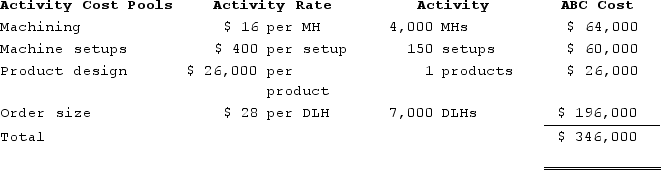

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product A79B is computed as follows: c. & d. through g. The activity rates would be computed as follows for the ABC system:

c. & d. through g. The activity rates would be computed as follows for the ABC system: The overhead cost charged to Product L73Z under the ABC system is:

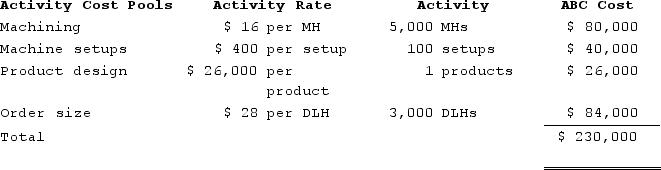

The overhead cost charged to Product L73Z under the ABC system is: The overhead cost charged to Product A79B under the ABC system is:

The overhead cost charged to Product A79B under the ABC system is:

Learning Objectives

- Evaluate the assignment of manufacturing overhead expenses utilizing plantwide and activity-based costing methods.

Related questions

Vito Corporation Manufactures Two Products: Product F77I and Product I48D ...

Aresco Corporation Manufactures Two Products: Product G51B and Product E48X ...

Immen Corporation Manufactures Two Products: Product B82O and Product P99Y ...

Meli Corporation Manufactures Two Products: Product L61P and Product B60E ...

Overhead Costs ...