Asked by eliza mooradian on May 01, 2024

Verified

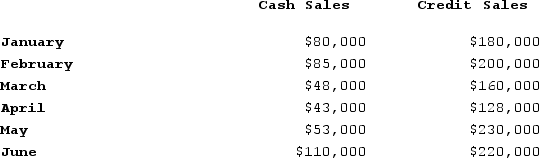

The LaGrange Corporation had the following budgeted sales for the first half of the current year:  The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:Collections on sales:50% in month of sale40% in month following sale10% in second month following saleThe accounts receivable balance on January 1 of the current year was $75,000, of which $47,000 represents uncollected December sales and $28,000 represents uncollected November sales.The total cash collected during January by LaGrange Corporation would be:

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:Collections on sales:50% in month of sale40% in month following sale10% in second month following saleThe accounts receivable balance on January 1 of the current year was $75,000, of which $47,000 represents uncollected December sales and $28,000 represents uncollected November sales.The total cash collected during January by LaGrange Corporation would be:

A) $321,000

B) $264,000

C) $94,000

D) $235,600

Cash Collected

The total amount of money received from sales, services, or other business activities.

Accounts Receivable Balance

The total amount of money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

- Recognize the role of sales forecasting in budget preparation.

Verified Answer

MM

Michael MutindaMay 08, 2024

Final Answer :

D

Explanation :

To determine the total cash collected during January, we need to calculate the collections on sales made in January and the collections on sales made in the previous months that were not collected as of January 1.

Collections on January sales:

50% x $190,000 = $95,000 (collected in January)

40% x $190,000 = $76,000 (collected in February)

10% x $190,000 = $19,000 (collected in March)

Collections on previous months' sales:

$47,000 (for December sales)

50% x $130,000 (for November sales) = $65,000

40% x $130,000 = $52,000

10% x $130,000 = $13,000

Total cash collected during January:

$95,000 (collections on January sales) + $47,000 (collections on December sales) + $65,000 (collections on November sales) = $207,000

However, we must subtract the accounts receivable balance on January 1 that is attributable to January and previous months' sales:

$190,000 (January sales) - $95,000 (collected in January) = $95,000 (accounts receivable for January sales)

$95,000 (January sales receivable) + $47,000 (December sales receivable) + $65,000 (November sales receivable) = $207,000 (total accounts receivable on January 1)

$207,000 (total accounts receivable on January 1) - $75,000 (total accounts receivable balance on January 1) = $132,000 (increase in accounts receivable from December to January)

Therefore, the total cash collected during January by LaGrange Corporation is:

$207,000 - $132,000 = $75,000 (cash collections during January from previous months' sales)

$207,000 + $75,000 = $282,000 (total cash collections during January)

However, we need to subtract the increase in accounts receivable from December to January that is attributable to January sales:

$282,000 - $95,000 = $187,000 (cash collections during January from January sales)

Therefore, the answer is D: $235,600.

Collections on January sales:

50% x $190,000 = $95,000 (collected in January)

40% x $190,000 = $76,000 (collected in February)

10% x $190,000 = $19,000 (collected in March)

Collections on previous months' sales:

$47,000 (for December sales)

50% x $130,000 (for November sales) = $65,000

40% x $130,000 = $52,000

10% x $130,000 = $13,000

Total cash collected during January:

$95,000 (collections on January sales) + $47,000 (collections on December sales) + $65,000 (collections on November sales) = $207,000

However, we must subtract the accounts receivable balance on January 1 that is attributable to January and previous months' sales:

$190,000 (January sales) - $95,000 (collected in January) = $95,000 (accounts receivable for January sales)

$95,000 (January sales receivable) + $47,000 (December sales receivable) + $65,000 (November sales receivable) = $207,000 (total accounts receivable on January 1)

$207,000 (total accounts receivable on January 1) - $75,000 (total accounts receivable balance on January 1) = $132,000 (increase in accounts receivable from December to January)

Therefore, the total cash collected during January by LaGrange Corporation is:

$207,000 - $132,000 = $75,000 (cash collections during January from previous months' sales)

$207,000 + $75,000 = $282,000 (total cash collections during January)

However, we need to subtract the increase in accounts receivable from December to January that is attributable to January sales:

$282,000 - $95,000 = $187,000 (cash collections during January from January sales)

Therefore, the answer is D: $235,600.

Learning Objectives

- Recognize the role of sales forecasting in budget preparation.

Related questions

The LaGrange Corporation Had the Following Budgeted Sales for the ...

Which of the Following Is Done to Improve the Reliability ...

The Master Budgeting Process Typically Begins with the Sales Budget ...

When Preparing the Cash Budget,all of the Following Should Be ...

Snap,Inc,Provides the Following Data for the Next Three Months ...