Asked by Austin Guthrie on May 10, 2024

Verified

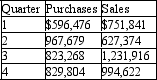

Johnston Distributing, Inc. files quarterly GST returns. The purchases on which it paid the GST and the sales on which it collected the GST for the last four quarters were as follows:

Calculate the GST remittance or refund due for each quarter.

GST Remittance

This is the process of sending the collected Goods and Services Tax to the governing tax authority.

GST Returns

The periodic filing with the taxation authority detailing sales, the GST collected on sales, and the GST paid on purchases.

- Understanding and application of tax calculations for businesses.

- Comprehension of GST and HST principles including remittance and refunds.

Verified Answer

YU

Learning Objectives

- Understanding and application of tax calculations for businesses.

- Comprehension of GST and HST principles including remittance and refunds.

Related questions

Sawchuk's Home and Garden Centre Files Monthly HST Returns ...

With Respect to the Income Tax Formula,which of the Following ...

For Equivalent Amounts of Taxable Income,the Total Tax Liability of ...

With Respect to the Income Tax Formula,which of the Following ...

Which of the Following Statements Is Correct ...