Asked by grace kelly on Jun 13, 2024

Verified

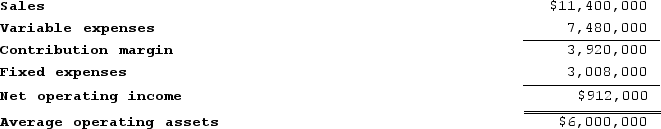

Ranallo Incorporated reported the following results from last year's operations:

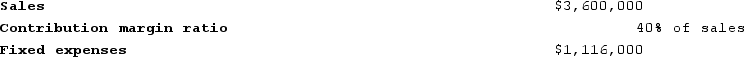

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

11. What was last year's residual income?

12. What is the residual income of this year's investment opportunity?

13. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

14. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

Investment Opportunity

A potential venture, asset, or market where investing could yield profitable returns.

Required Rate of Return

The minimum return an investor expects to earn on an investment, considering its risk level and alternative opportunities.

Margin

The difference between the selling price of a product or service and its cost, expressed as a percentage of the selling price.

- Appraise the return on investment from novel investment avenues and their influence on the entirety of company operations.

Verified Answer

2. Last year's Turnover = Sales ÷ Average operating assets = $11,400,000 ÷ $6,000,000 = 1.90

3. Last year's Return on investment = Net operating income ÷ Average operating assets = $912,000 ÷ $6,000,000 = 15.2%

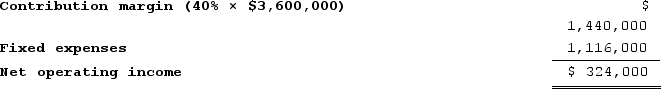

4. The margin for this year's investment opportunity is:

Margin = Net operating income ÷ Sales = $324,000 ÷ $3,600,000 = 9.0%

Margin = Net operating income ÷ Sales = $324,000 ÷ $3,600,000 = 9.0%5. The turnover for this year's investment opportunity is:

Turnover = Sales ÷ Average operating assets = $3,600,000 ÷ $1,800,000 = 2.00

6. The return on investment for this year's investment opportunity is:

Return on investment = Net operating income ÷ Average operating assets = $324,000 ÷ $1,800,000 = 18.0%

7. If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $912,000 + $324,000 = $1,236,000

Sales = $11,400,000 + $3,600,000 = $15,000,000

Margin = Net operating income ÷ Sales = $1,236,000 ÷ $15,000,000 = 8.2%

8. If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $11,400,000 + $3,600,000 = $15,000,000

Average operating assets = $6,000,000 + $1,800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $15,000,000 ÷ $7,800,000 = 1.92

9. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

return on investment = Net operating income ÷ Average operating assets = $1,236,000 ÷ $7,800,000 = 15.8%

10. The chief executive officer would pursue the investment opportunity because it increases the overall return on investment. The owners of the company would want the chief executive officer to pursue the investment opportunity because its return on investment is greater than the company's minimum required rate of return.

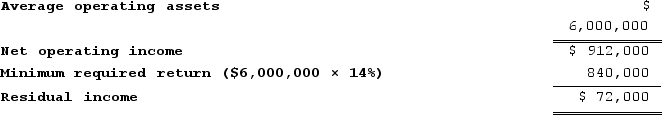

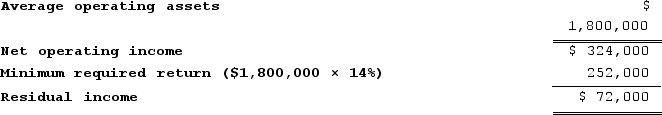

11. Last year's residual income was:

12. The residual income for this year's investment opportunity is:

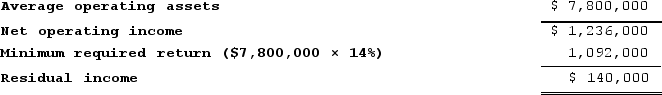

12. The residual income for this year's investment opportunity is: 13. If the company pursues the investment opportunity, this year's residual income will be:

13. If the company pursues the investment opportunity, this year's residual income will be: 14. The chief executive officer would pursue the investment opportunity because residual income would increase by $72,000.

14. The chief executive officer would pursue the investment opportunity because residual income would increase by $72,000.

Learning Objectives

- Appraise the return on investment from novel investment avenues and their influence on the entirety of company operations.

Related questions

Willing Incorporated Reported the Following Results from Last Year's Operations ...

Worley Incorporated Reported the Following Results from Last Year's Operations ...

Wolley Incorporated Reported the Following Results from Last Year's Operations ...

The Clipper Corporation Had Net Operating Income of $380,000 and ...

Familia Incorporated Reported the Following Results from Last Year's Operations ...