Asked by HANNAH MARTE on Apr 25, 2024

Verified

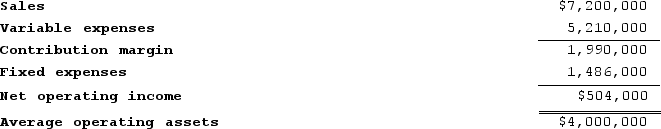

Wolley Incorporated reported the following results from last year's operations:

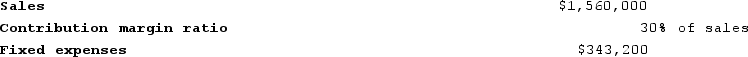

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

Margin

The difference between the selling price of a product and its cost, expressed as a percentage of the selling price.

Turnover

The rate at which inventory or assets of a business are replaced during a given period, often used as a measure of sales or operational efficiency.

Return on Investment

A financial metric used to calculate the profitability of an investment, measuring the gain or loss generated on an investment relative to the amount of money invested.

- Evaluate the profitability of new investment opportunities and their effect on the company's overall performance.

Verified Answer

2. Last year's Turnover = Sales ÷ Average operating assets = $7,200,000 ÷ $4,000,000 = 1.80

3. Last year's Return on investment = Net operating income ÷ Average operating assets = $504,000 ÷ $4,000,000 = 12.6%

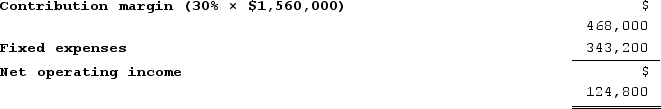

4. The margin for this year's investment opportunity is:

Margin = Net operating income ÷ Sales = $124,800 ÷ $1,560,000 = 8.0%

Margin = Net operating income ÷ Sales = $124,800 ÷ $1,560,000 = 8.0%5. The turnover for this year's investment opportunity is:

Turnover = Sales ÷ Average operating assets = $1,560,000 ÷ $1,200,000 = 1.30

6. The return on investment for this year's investment opportunity is:

Return on investment = Net operating income ÷ Average operating assets = $124,800 ÷ $1,200,000 = 10.4%

7. If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $504,000 + $124,800 = $628,800

Sales = $7,200,000 + $1,560,000 = $8,760,000

Margin = Net operating income ÷ Sales = $628,800 ÷ $8,760,000 = 7.2%

8. If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $7,200,000 + $1,560,000 = $8,760,000

Average operating assets = $4,000,000 + $1,200,000 = $5,200,000

Turnover = Sales ÷ Average operating assets = $8,760,000 ÷ $5,200,000 = 1.68

9. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

Return on investment = Net operating income ÷ Average operating assets = $628,800 ÷ $5,200,000 = 12.1%

10. The chief executive officer would not pursue the investment opportunity because it decreases the overall return on investment. The owners of the company would not want the chief executive officer to pursue the investment opportunity because its return on investment is less than the company's minimum required rate of return.

Learning Objectives

- Evaluate the profitability of new investment opportunities and their effect on the company's overall performance.

Related questions

Willing Incorporated Reported the Following Results from Last Year's Operations ...

Familia Incorporated Reported the Following Results from Last Year's Operations ...

Criner Incorporated Reported the Following Results from Last Year's Operations ...

Ranallo Incorporated Reported the Following Results from Last Year's Operations ...

The Clipper Corporation Had Net Operating Income of $380,000 and ...