Asked by Chyna Forrester on Jun 14, 2024

Verified

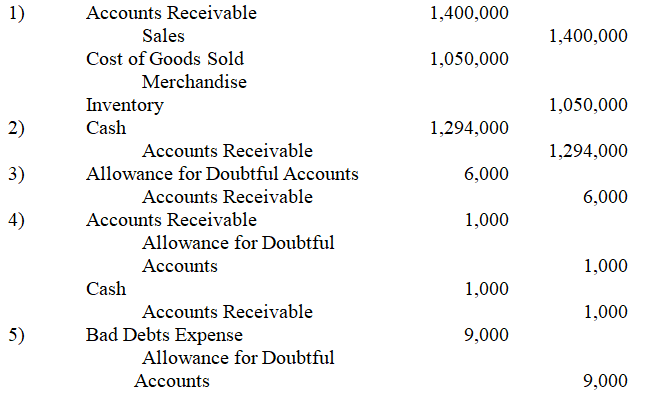

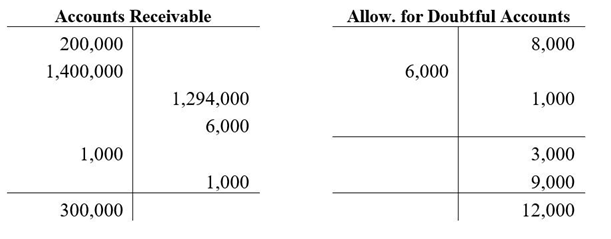

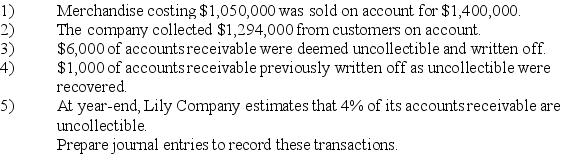

The Lily Company uses the percent of receivables method of accounting for uncollectible accounts receivable,and a perpetual inventory system.As of January 1,its net accounts receivable totaled $192,000 (Accounts Receivable $200,000 less an $8,000 Allowance for Doubtful Accounts).During the current year,the following transactions occurred.

Percent of Receivables Method

An accounting method used to estimate the amount of accounts receivable that will not be collected by calculating a percentage of receivables deemed uncollectible.

Uncollectible Accounts Receivable

Accounts from customers that are considered unrecoverable, leading to a write-off as a bad debt expense.

Allowance

A reduction from the gross amount of an asset or liability, created to account for potential future adjustments such as doubtful debts or returns.

- Acquire knowledge to differentiate various techniques for handling accounts receivable that cannot be collected.

- Clarify and figure out the expense incurred from bad debts utilizing the allowance method.

Verified Answer

Learning Objectives

- Acquire knowledge to differentiate various techniques for handling accounts receivable that cannot be collected.

- Clarify and figure out the expense incurred from bad debts utilizing the allowance method.

Related questions

The Branson Company Uses the Percent of Sales Method of ...

Using the Allowance Method for Bad Debts Expense,the Allowance for ...

The Allowance Method of Accounting for Bad Debts Requires an ...

A Company That Uses the Percent of Sales to Account ...

On February 1,a Customer's Account Balance of $2,300 Was Deemed ...