Asked by Anita Inthavong on Jun 20, 2024

Verified

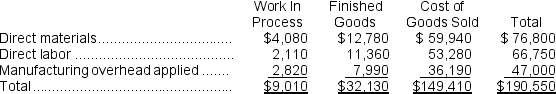

Fils Inc.has provided the following data for the month of March.There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was underapplied by $4,000. The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

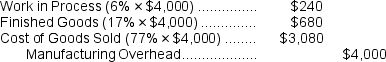

Manufacturing overhead for the month was underapplied by $4,000. The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for March would include the following:

A) debit to Cost of Goods Sold of $3,080

B) debit to Cost of Goods Sold of $149,410

C) credit to Cost of Goods Sold of $3,080

D) credit to Cost of Goods Sold of $149,410

Underapplied Manufacturing Overhead

An occurrence where the overhead expenses budgeted for manufacturing fall short of the overhead costs that were truly incurred.

Allocation

The process of assigning indirect costs to specific cost objects, such as products or departments.

Journal Entry

A record in accounting that logs a transaction and shows the affected accounts in debit and credit form.

- Understand how to allocate underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold accounts.

Verified Answer

BB

Barrianne BrownJun 22, 2024

Final Answer :

A

Explanation :

Allocating underapplied manufacturing overhead increases the balances in the inventory and cost of goods sold accounts, resulting in debits to those accounts.

Learning Objectives

- Understand how to allocate underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold accounts.