Asked by Zachary Whetstone on Jul 11, 2024

Verified

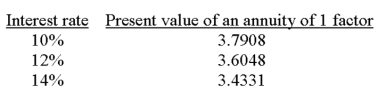

A company is considering a 5-year project. It plans to invest $60,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Internal Rate

Also known as the internal rate of return (IRR), it is the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

- Utilize the internal rate of return (IRR) and profitability index in comparing and selecting projects.

Verified Answer

MG

Manbir GhumanJul 15, 2024

Final Answer :

Investment/Annual net cash flows = $60,000/$16,200 = 3.704

The present value factor of 3.704 falls between 10% and 12%. This project earns more than 10% but less than 12%. If the hurdle rate is 12%, this project should be rejected.

The present value factor of 3.704 falls between 10% and 12%. This project earns more than 10% but less than 12%. If the hurdle rate is 12%, this project should be rejected.

Learning Objectives

- Utilize the internal rate of return (IRR) and profitability index in comparing and selecting projects.