Asked by Sherelle Robinson on May 22, 2024

Verified

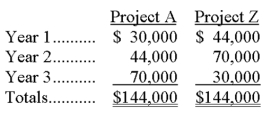

A company is considering two alternative investment opportunities, each of which requires an initial cash outlay of $110,000. The expected net cash flows from the two projects follow:

Required:

(1) Based on a comparison of their net present values, and assuming the same discount rate (greater than zero) is required for both projects, which project is the better investment? (Check one answer.)

________________ Project A

________________ Project Z

________________ The projects are equally desirable

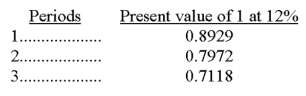

(2) Use the table values below to find the net present value of the cash flows associated with Project A, discounted at 12%:

Discount Rate

The interest rate charged to commercial banks and other financial institutions for loans received from the central bank or the rate used in discounted cash flow analysis to determine the present value of future cash flows.

- Understand thoroughly and make use of net present value (NPV) and decision-making rules for investments in the selection of investment projects.

- Use the internal rate of return (IRR) and profitability index to compare and decide on projects.

Verified Answer

KC

Kaitlyn ChristieMay 25, 2024

Final Answer :

(1) Project Z because its cash flows are received earlier than Project A.

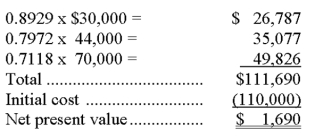

(2)

(2)

Learning Objectives

- Understand thoroughly and make use of net present value (NPV) and decision-making rules for investments in the selection of investment projects.

- Use the internal rate of return (IRR) and profitability index to compare and decide on projects.

Related questions

A Company Is Considering a 5-Year Project ...

A Company Is Considering the Purchase of New Equipment for ...

A Company Has a Decision to Make Between Two Investment ...

Majestic Theaters Is Considering Investing in Some New Projection Equipment ...

PEI Corp's Management Has Determined That Two Independent Projects Have ...