Asked by Islam Soliman on Jul 22, 2024

Verified

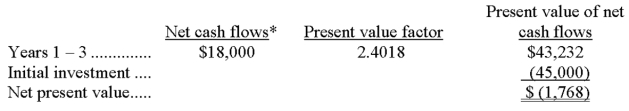

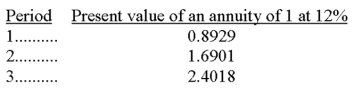

A company is considering the purchase of new equipment for $45,000. The projected after-tax net income is $3,000 after deducting $15,000 of depreciation. The machine has a useful life of 3 years and no salvage value. Management of the company requires a 12% return on investment. The present value of an annuity of 1 for various periods follows:

What is the net present value of this machine assuming all cash flows occur at year-end?

Return On Investment

A measure used to evaluate the efficiency or profitability of an investment, calculated by dividing the net profit by the cost of the investment.

- assimilate and implement net present value (NPV) along with the principles of investment selection in deciding on investment projects.

Verified Answer

SM

Learning Objectives

- assimilate and implement net present value (NPV) along with the principles of investment selection in deciding on investment projects.

Related questions

A Company Is Considering Two Alternative Investment Opportunities, Each of ...

A Company Has a Decision to Make Between Two Investment ...

Merritt Company Is Considering a New Project That Has a ...

PEI Corp's Management Has Determined That Two Independent Projects Have ...

Majestic Theaters Is Considering Investing in Some New Projection Equipment ...