Asked by Sheree Rouse on Jun 11, 2024

Verified

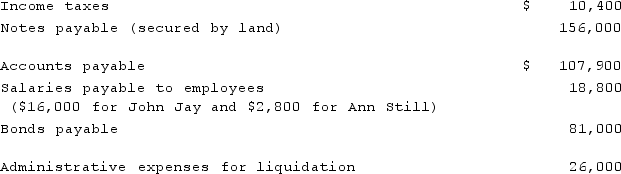

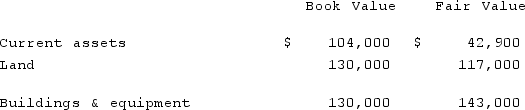

A company that was to be liquidated had the following liabilities:  The company had the following assets:

The company had the following assets:  Prepare a schedule to show the amount of total unsecured non-priority liabilities.

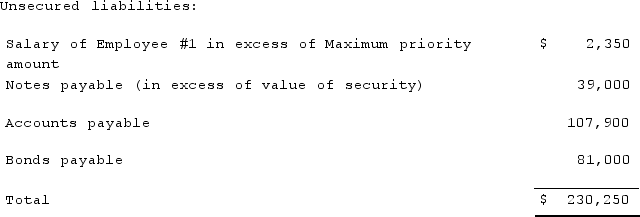

Prepare a schedule to show the amount of total unsecured non-priority liabilities.

Unsecured Non-priority Liabilities

Debts that are not backed by collateral and do not have priority status in case of the debtor's bankruptcy.

Liquidated

The process of converting assets into cash or using them to discharge liabilities, often occurring during the winding up of a business.

- Ascertain the disbursement to unsecured creditors during liquidation events.

Verified Answer

CC

Learning Objectives

- Ascertain the disbursement to unsecured creditors during liquidation events.