Asked by Kolby Finnie on Jun 11, 2024

Verified

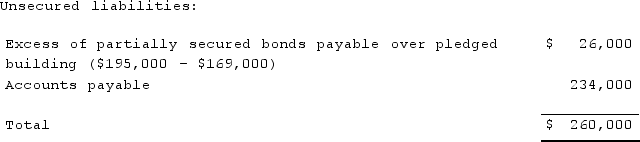

Lucky Co. had cash of $65,000, inventory worth $117,000, and a building worth $169,000. The company's debts consisted of accounts payable of $234,000, a note payable of $104,000 (secured by the inventory), liabilities with priority of $26,000, and a bond payable of $195,000 (secured by the building).Prepare a schedule to show the amount of total unsecured liabilities.

Net Realizable Value

The estimated selling price of goods minus the cost of their sale or disposal.

Unsecured Liabilities

Debts or obligations that are not protected by a security interest or collateral, making them riskier for lenders.

Liabilities With Priority

Liabilities with priority refer to debts or obligations that must be paid before others in the event of a liquidation or bankruptcy.

- Gauge the financial proceeds to unsecured creditors under liquidation conditions.

- Evaluate assets and liabilities to prepare for liquidation or reorganization decisions.

Verified Answer

MW

Learning Objectives

- Gauge the financial proceeds to unsecured creditors under liquidation conditions.

- Evaluate assets and liabilities to prepare for liquidation or reorganization decisions.