Asked by David Adamovich on May 29, 2024

Verified

If the company marks up its manufacturing costs by 20% then the selling price for Job K928 would be closest to:

A) $4,275.00

B) $5,643.00

C) $5,130.00

D) $855.00

Markup

A percentage added to the cost price of goods to cover overhead and profit.

Selling Price

Selling price is the amount of money a buyer pays to purchase a product or service from a seller.

Manufacturing Costs

The total expense involved in the creation of a product, including raw materials, labor, and overhead costs.

- Learn how to calculate selling prices based on manufacturing cost markups.

Verified Answer

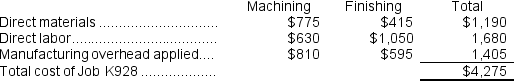

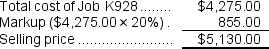

Manufacturing cost of Job K928 = $4,275.00

Markup = 20% of manufacturing cost = 20% of $4,275.00 = $855.00

Selling price = Manufacturing cost + Markup = $4,275.00 + $855.00 = $5,130.00

Therefore, the closest selling price for Job K928 is $5,130.00, which is option C.

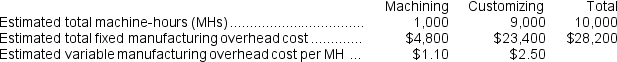

= $136,800 + ($1.80 per machine-hour × 19,000 machine-hours)

= $136,800 +$34,200 = $171,000

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base incurred = $171,000 ÷ 19,000 machine-hours = $9.00 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $9.00 per machine-hour × 90 machine-hours = $810

Finishing Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $69,600 + ($3.20 per direct labor-hour × 8,000 direct labor-hours)

= $69,600 + $25,600 = $95,200

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base incurred = $95,200 ÷8,000 direct labor-hours = $11.90 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $11.90 per direct labor-hour × 50 direct labor-hours = $595

Reference: CH02-Ref30

Reference: CH02-Ref30Janicki Corporation has two manufacturing departments--Machining and Customizing.The company used the following data at the beginning of the year to calculate predetermined overhead rates:

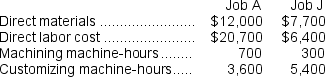

During the most recent month, the company started and completed two jobs--Job A and Job J.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job J.There were no beginning inventories.Data concerning those two jobs follow:

Learning Objectives

- Learn how to calculate selling prices based on manufacturing cost markups.

Related questions

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

Lupo Corporation Uses a Job-Order Costing System with a Single ...

Nielsen Corporation Has Two Manufacturing Departments--Machining and Assembly ...

Opunui Corporation Has Two Manufacturing Departments--Molding and Finishing ...