Asked by Karan Patel on May 18, 2024

Verified

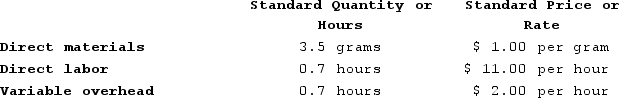

Bulluck Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in July.

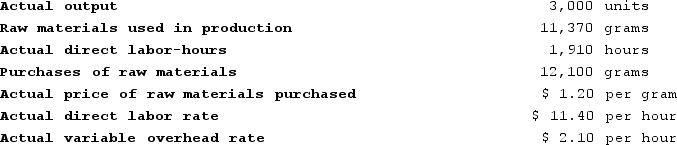

The company reported the following results concerning this product in July.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for July is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for July is:

A) $191 Unfavorable

B) $210 Unfavorable

C) $210 Favorable

D) $191 Favorable

Rate Variance

The difference between the actual rate paid for goods or services and the expected (or standard) rate, most often related to labor or materials.

Direct Labor-Hours

Sum of working hours of staff directly participating in the production process of an item.

- Grasp the methodology and significance behind variable manufacturing overhead variances, including distinctions in efficiency and rate.

Verified Answer

KC

Kajal ChampaneriMay 22, 2024

Final Answer :

A

Explanation :

To calculate the variable overhead rate variance, we need to compare the actual variable overhead rate per direct labor hour to the standard variable overhead rate per direct labor hour.

Actual variable overhead rate = Actual variable overhead costs ÷ Actual direct labor hours

= $35,700 ÷ 1,800 hours

= $19.83 per direct labor hour

Standard variable overhead rate = Total standard variable overhead costs ÷ Total standard direct labor hours

= ($44,000 ÷ 2,000 hours)

= $22 per direct labor hour

Variable overhead rate variance = (Actual variable overhead rate - Standard variable overhead rate) x Actual direct labor hours

= ($19.83 - $22) x 1,800

= $191 Unfavorable

Therefore, the correct answer is A.

Actual variable overhead rate = Actual variable overhead costs ÷ Actual direct labor hours

= $35,700 ÷ 1,800 hours

= $19.83 per direct labor hour

Standard variable overhead rate = Total standard variable overhead costs ÷ Total standard direct labor hours

= ($44,000 ÷ 2,000 hours)

= $22 per direct labor hour

Variable overhead rate variance = (Actual variable overhead rate - Standard variable overhead rate) x Actual direct labor hours

= ($19.83 - $22) x 1,800

= $191 Unfavorable

Therefore, the correct answer is A.

Learning Objectives

- Grasp the methodology and significance behind variable manufacturing overhead variances, including distinctions in efficiency and rate.

Related questions

Dirickson Incorporated Has Provided the Following Data Concerning One of ...

Dirickson Incorporated Has Provided the Following Data Concerning One of ...

Ravena Labs ...

Majer Corporation Makes a Product with the Following Standard Costs ...

Majer Corporation Makes a Product with the Following Standard Costs ...