Asked by Chris Huynh on Jun 15, 2024

Verified

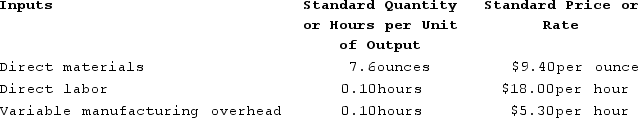

Dirickson Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for July:

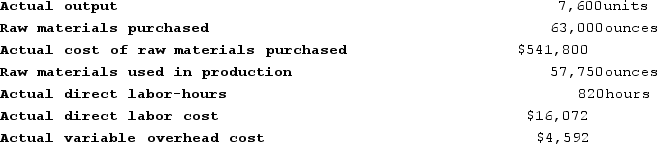

The company has reported the following actual results for the product for July:

The variable overhead rate variance for the month is closest to:

The variable overhead rate variance for the month is closest to:

A) $228 Favorable

B) $246 Unfavorable

C) $246 Favorable

D) $228 Unfavorable

Variable Overhead

Costs that vary with production volume, such as supplies and utilities for manufacturing.

Rate Variance

The difference between the actual rate of expense or income and its expected (standard) rate, often used in variance analysis.

Direct Labor-Hours

The cumulative hours employees directly participating in the production process have worked.

- Learn the procedure and meaning of calculating variances in variable manufacturing overhead, considering efficiency and rate variances.

Verified Answer

CP

Christelle PagonisJun 22, 2024

Final Answer :

B

Explanation :

To calculate the variable overhead rate variance, we need to first calculate the actual direct labor-hours worked:

Actual Direct Labor-Hours = Actual Labor Hours x Actual Production = 1,525 x 800 = 1,220,000

Next, we can calculate the amount of variable overhead that should have been applied based on the standard rate:

Standard Variable Overhead Rate = Variable Manufacturing Overhead / Standard Direct Labor-Hours = $2,440 / 1,200 = $2.03 per DLH

Expected Variable Overhead = Standard Variable Overhead Rate x Actual Direct Labor-Hours = $2.03 x 1,220,000 = $2,476,600

Finally, we can calculate the variable overhead rate variance:

Variable Overhead Rate Variance = Actual Variable Overhead - Expected Variable Overhead

Actual Variable Overhead = $2,500,000

Variable Overhead Rate Variance = $2,500,000 - $2,476,600 = $23,400 unfavorable

Therefore, the closest answer choice is B) $246 Unfavorable.

Actual Direct Labor-Hours = Actual Labor Hours x Actual Production = 1,525 x 800 = 1,220,000

Next, we can calculate the amount of variable overhead that should have been applied based on the standard rate:

Standard Variable Overhead Rate = Variable Manufacturing Overhead / Standard Direct Labor-Hours = $2,440 / 1,200 = $2.03 per DLH

Expected Variable Overhead = Standard Variable Overhead Rate x Actual Direct Labor-Hours = $2.03 x 1,220,000 = $2,476,600

Finally, we can calculate the variable overhead rate variance:

Variable Overhead Rate Variance = Actual Variable Overhead - Expected Variable Overhead

Actual Variable Overhead = $2,500,000

Variable Overhead Rate Variance = $2,500,000 - $2,476,600 = $23,400 unfavorable

Therefore, the closest answer choice is B) $246 Unfavorable.

Learning Objectives

- Learn the procedure and meaning of calculating variances in variable manufacturing overhead, considering efficiency and rate variances.

Related questions

Ravena Labs ...

Bulluck Corporation Makes a Product with the Following Standard Costs ...

Dirickson Incorporated Has Provided the Following Data Concerning One of ...

Majer Corporation Makes a Product with the Following Standard Costs ...

Puvo, Incorporated, Manufactures a Single Product in Which Variable Manufacturing ...