Asked by Mariia Dublevska on Jun 22, 2024

Verified

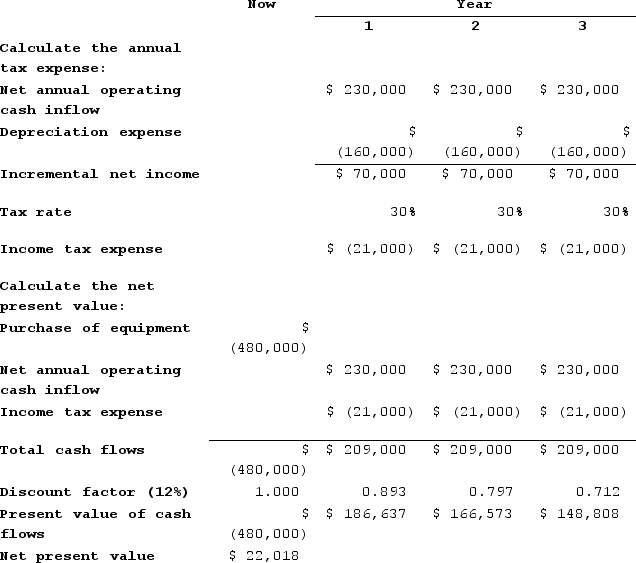

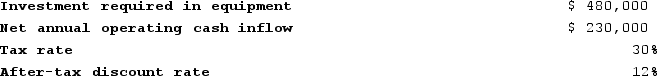

Condo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Operating Cash Inflow

Cash generated from a company's primary business operations, excluding non-operational sources like investments or financing.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, making the expense predictable and consistent.

Income Taxes

Taxes levied by governments on individuals' or businesses' net income, where the amount owed varies based on the level of the income earned.

- Compute and elucidate the net present value (NPV) of an investment project, taking into account elements like cash inflows and outflows, residual value, and working capital requirements.

- Comprehend the effect of depreciation and tax considerations on investment choices.

Verified Answer

Learning Objectives

- Compute and elucidate the net present value (NPV) of an investment project, taking into account elements like cash inflows and outflows, residual value, and working capital requirements.

- Comprehend the effect of depreciation and tax considerations on investment choices.

Related questions

Ariel Corporation Has Provided the Following Information Concerning a Capital ...

Nessen Corporation Has Provided the Following Information Concerning a Capital ...

Morefield Corporation Has Provided the Following Information Concerning a Capital ...

(Ignore Income Taxes in This Problem ...

(Ignore Income Taxes in This Problem ...