Asked by Landrie Pierce on Jul 07, 2024

Verified

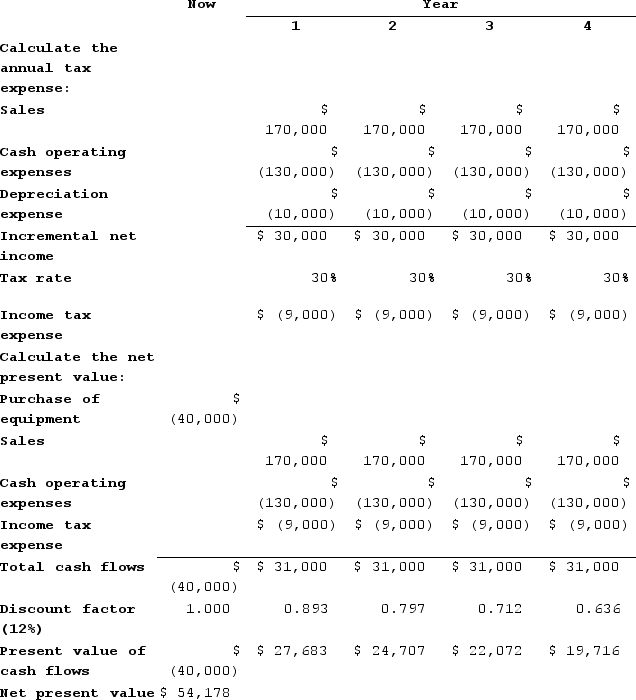

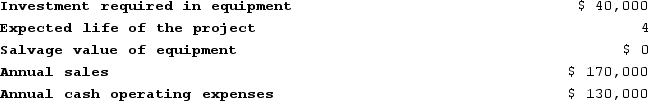

Morefield Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

After-Tax Discount

The reduction in price or cost of an item after accounting for the impact of taxes.

Straight-Line Depreciation

Straight-line depreciation is a technique that spreads the expense of a physical asset evenly across its useful lifespan in uniform yearly instalments.

Income Tax Rate

The percentage of earnings taxed on entities or individuals.

- Formulate and communicate the net present value (NPV) of a financial project involving capital budgeting, focusing on cash inflows and outflows, the value at asset disposal, and the maintenance of adequate working capital.

- Identify the influence of depreciation and tax elements on investment decision-making.

Verified Answer

ZK

Learning Objectives

- Formulate and communicate the net present value (NPV) of a financial project involving capital budgeting, focusing on cash inflows and outflows, the value at asset disposal, and the maintenance of adequate working capital.

- Identify the influence of depreciation and tax elements on investment decision-making.

Related questions

Ariel Corporation Has Provided the Following Information Concerning a Capital ...

Condo Corporation Has Provided the Following Information Concerning a Capital ...

Nessen Corporation Has Provided the Following Information Concerning a Capital ...

(Ignore Income Taxes in This Problem ...

(Ignore Income Taxes in This Problem ...