Asked by Christopher Flores on May 18, 2024

Verified

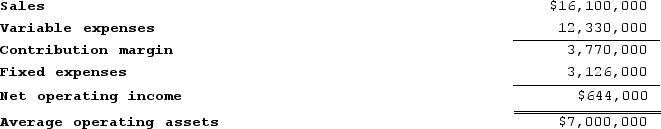

Criner Incorporated reported the following results from last year's operations:

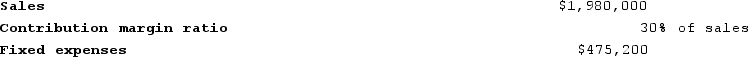

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

Required:

Required:

1.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

2. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

Return on Investment

A financial performance measure used to evaluate the efficiency or profitability of an investment, calculated as the net profit divided by the cost of the investment.

Investment Opportunity

An asset or item that can potentially generate a significant return or profit through appreciation, dividends, or interest.

Operations

The day-to-day activities involved in running a business, focusing on producing goods and services efficiently and effectively.

- Examine the return on investment for emerging investment prospects and how they influence the total performance of the company.

Verified Answer

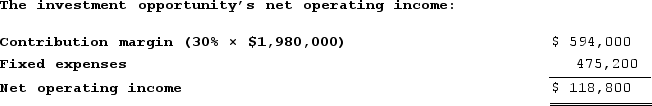

2. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

Net operating income = $644,000 + $118,800 = $762,800

Net operating income = $644,000 + $118,800 = $762,800Average operating assets = $7,000,000 + $1,800,000 = $8,800,000

Return on investment = Net operating income ÷ Average operating assets = $762,800 ÷ $8,800,000 = 8.7%

Learning Objectives

- Examine the return on investment for emerging investment prospects and how they influence the total performance of the company.

Related questions

Willing Incorporated Reported the Following Results from Last Year's Operations ...

Worley Incorporated Reported the Following Results from Last Year's Operations ...

Wolley Incorporated Reported the Following Results from Last Year's Operations ...

The Clipper Corporation Had Net Operating Income of $380,000 and ...

Familia Incorporated Reported the Following Results from Last Year's Operations ...