Asked by Jhane Hemingway on May 27, 2024

Verified

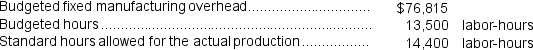

Dapice Incorporated makes a single product--a critical part used in commercial airline seats.The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period.Data concerning the most recent year appear below:  The fixed overhead volume variance is:

The fixed overhead volume variance is:

A) $5,121 U

B) $5,121 F

C) $21,121 F

D) $21,121 U

Fixed Overhead Volume Variance

The difference between the budgeted fixed overhead and the applied fixed overhead, which is attributed to the variance in the volume of production.

Standard Labor-Hours

A measurement used in accounting to represent the number of labor hours expected to produce one unit of output.

- Analyze and explain the discrepancies in the budget allocation and material usage for fixed manufacturing overhead.

Verified Answer

SM

Shaghayegh MehrvarzMay 30, 2024

Final Answer :

B

Explanation :

The fixed overhead volume variance measures the difference between the budgeted fixed overhead costs and the actual fixed overhead costs incurred during the period. It can be calculated as follows:

Fixed overhead volume variance = (Budgeted fixed overhead rate × Budgeted standard labor-hours) - Actual fixed overhead costs

In this case, the budgeted fixed overhead rate is $50, and the budgeted standard labor-hours are 22,000. Therefore, the budgeted fixed overhead costs are:

Budgeted fixed overhead costs = Budgeted fixed overhead rate × Budgeted standard labor-hours

= $50 × 22,000

= $1,100,000

The actual fixed overhead costs incurred during the period were $1,105,121. Therefore, the fixed overhead volume variance is:

Fixed overhead volume variance = ($1,100,000) - ($1,105,121)

= $5,121 F

Therefore, the correct answer is B) $5,121 F.

Fixed overhead volume variance = (Budgeted fixed overhead rate × Budgeted standard labor-hours) - Actual fixed overhead costs

In this case, the budgeted fixed overhead rate is $50, and the budgeted standard labor-hours are 22,000. Therefore, the budgeted fixed overhead costs are:

Budgeted fixed overhead costs = Budgeted fixed overhead rate × Budgeted standard labor-hours

= $50 × 22,000

= $1,100,000

The actual fixed overhead costs incurred during the period were $1,105,121. Therefore, the fixed overhead volume variance is:

Fixed overhead volume variance = ($1,100,000) - ($1,105,121)

= $5,121 F

Therefore, the correct answer is B) $5,121 F.

Explanation :

Fixed component of the predetermined overhead rate = $76,815/13,500 labor-hours

= $5.69 per labor-hour

Volume variance = Budgeted fixed overhead - Fixed overhead applied to work in process

= $76,815 - ($5.69 per labor-hour × 14,400 labor-hours)

= $76,815 - ($81,936)

= $5,121 F

or

Volume variance = Fixed component of the predetermined overhead rate x (Denominator hours - Standard hours allowed for the actual output)

= $5.69 per labor-hour x (13,500 labor-hours - 14,400 labor-hours)

= $5.69 per labor-hour x (13,500 labor-hours - 14,400 labor-hours)

= $5.69 per labor-hour x (-900 hours)

= $5,121 F

= $5.69 per labor-hour

Volume variance = Budgeted fixed overhead - Fixed overhead applied to work in process

= $76,815 - ($5.69 per labor-hour × 14,400 labor-hours)

= $76,815 - ($81,936)

= $5,121 F

or

Volume variance = Fixed component of the predetermined overhead rate x (Denominator hours - Standard hours allowed for the actual output)

= $5.69 per labor-hour x (13,500 labor-hours - 14,400 labor-hours)

= $5.69 per labor-hour x (13,500 labor-hours - 14,400 labor-hours)

= $5.69 per labor-hour x (-900 hours)

= $5,121 F

Learning Objectives

- Analyze and explain the discrepancies in the budget allocation and material usage for fixed manufacturing overhead.