Asked by Massiel Toribio Peralta on Jul 05, 2024

Verified

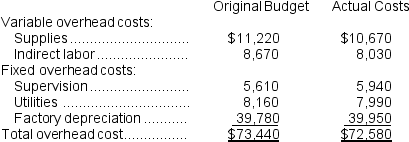

Lossing Corporation applies manufacturing overhead to products on the basis of standard machine-hours.Budgeted and actual overhead costs for the most recent month appear below:  The company based its original budget on 5,100 machine-hours.The company actually worked 4,800 machine-hours during the month.The standard hours allowed for the actual output of the month totaled 4,980 machine-hours.What was the overall fixed manufacturing overhead volume variance for the month?

The company based its original budget on 5,100 machine-hours.The company actually worked 4,800 machine-hours during the month.The standard hours allowed for the actual output of the month totaled 4,980 machine-hours.What was the overall fixed manufacturing overhead volume variance for the month?

A) $3,150 Unfavorable

B) $3,150 Favorable

C) $1,260 Unfavorable

D) $1,260 Favorable

Fixed Manufacturing Overhead

The consistent, non-variable costs incurred during the manufacturing process, not directly tied to production levels.

Volume Variance

The difference between the budgeted and actual volume of production, affecting fixed costs allocation.

Machine-Hours

A unit of measure representing the operation time of a machine, often used in allocating manufacturing costs based on machine usage.

- Evaluate and interpret the differences between budgeted and actual fixed manufacturing overheads in terms of volume.

Verified Answer

Budgeted variable manufacturing overhead costs / Budgeted machine-hours = $17,850 / 5,100 = $3.50 per machine-hour

Next, we can calculate the total variable manufacturing overhead variance:

Actual machine-hours * (Standard rate - Actual rate) = 4,800 * ($3.50 - $3.60) = $480 Unfavorable

Then, we can calculate the fixed manufacturing overhead volume variance:

Budgeted fixed manufacturing overhead - (Standard rate * Standard hours allowed) = $12,150 - ($3.50 * 4,980) = $1,260 Unfavorable

Therefore, the answer is C, $1,260 Unfavorable.

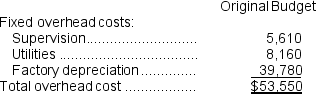

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $53,550 ÷ 5,100 machine-hours = $10.50 per machine-hour

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $53,550 ÷ 5,100 machine-hours = $10.50 per machine-hourVolume variance = Budgeted fixed overhead cost - Fixed overhead applied to work in process

= $53,550 - (4,980 machine-hours × $10.50 per machine-hour)

= $53,550 - $52,290

= $1,260 U

Learning Objectives

- Evaluate and interpret the differences between budgeted and actual fixed manufacturing overheads in terms of volume.

Related questions

Dapice Incorporated Makes a Single Product--A Critical Part Used in ...

Rodarta Corporation Applies Manufacturing Overhead to Products on the Basis ...

Alvino Corporation Manufactures One Product ...

Sobus Corporation Manufactures One Product ...

Platt Company Produces One Product a Putter Called PAR-Putter ...