Asked by Delaney Bacher on Jun 27, 2024

Verified

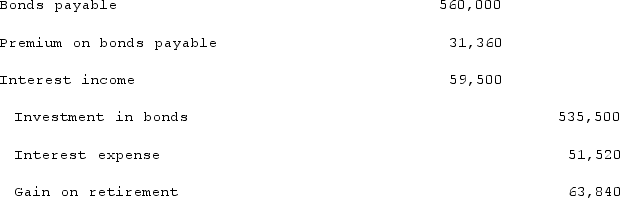

Fargus Corporation owned 51% of the voting common stock of Sanatee, Inc. The parent's interest was acquired several years ago on the date that the subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition price. On January 1, 2020, Sanatee sold $1,400,000 in ten-year bonds to the public at 108. The bonds pay a 10% interest rate every December 31. Fargus acquired 40% of these bonds on January 1, 2022, for 95% of the face value. Both companies utilized the straight-line method of amortization.What consolidation entry would be recorded in connection with these intra-entity bonds on December 31, 2022?

Voting Common Stock

Shares of a corporation giving holders the right to vote on corporate matters, such as the election of the board of directors.

Straight-Line Method

A method of calculating depreciation or amortization by evenly spreading the cost of an asset over its expected useful life.

Intra-Entity Bonds

Intra-Entity Bonds refer to bonds issued between entities within the same corporate group, used for internal finance restructuring or other strategic purposes.

- Compute and recognize consolidation entries for intra-entity bond transactions.

Verified Answer

RK

Learning Objectives

- Compute and recognize consolidation entries for intra-entity bond transactions.