Asked by Cooper Lumsden on May 12, 2024

Verified

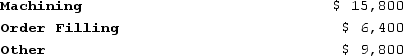

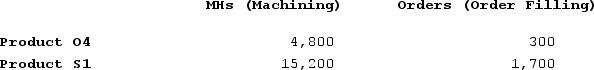

Handal Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

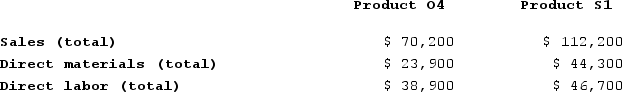

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

What is the overhead cost assigned to Product S1 under activity-based costing?

What is the overhead cost assigned to Product S1 under activity-based costing?

A) $12,008

B) $16,000

C) $5,440

D) $17,448

Overhead Cost

Expenses not directly tied to production, such as rent, utilities, and administrative salaries.

Product S1

A designated product, referred to as S1, typically used in examples or scenarios within the context of costing or managerial accounting.

- Calculate the allotment of overhead expenses for products and customers, guided by the principles of Activity-Based Costing.

Verified Answer

ZR

zacharya ranerMay 15, 2024

Final Answer :

D

Explanation :

To calculate the overhead cost assigned to Product S1, we need to first allocate overhead costs to the cost drivers (MHs and number of orders) in each activity cost pool.

For Machining activity cost pool:

Overhead rate = Machining costs / Total MHs = $20,800 / 6,500 = $3.20 per MH

Overhead cost assigned to S1 = MHs for S1 x Machining overhead rate

= 3,600 MHs x $3.20 per MH

= $11,520

For Order Filling activity cost pool:

Overhead rate = Order Filling costs / Total number of orders = $34,000 / 2,000 = $17 per order

Overhead cost assigned to S1 = Number of orders for S1 x Order Filling overhead rate

= 400 orders x $17 per order

= $6,800

Therefore, total overhead cost assigned to S1 under activity-based costing = $11,520 + $6,800 + $128

= $17,448

The correct answer is D, $17,448.

For Machining activity cost pool:

Overhead rate = Machining costs / Total MHs = $20,800 / 6,500 = $3.20 per MH

Overhead cost assigned to S1 = MHs for S1 x Machining overhead rate

= 3,600 MHs x $3.20 per MH

= $11,520

For Order Filling activity cost pool:

Overhead rate = Order Filling costs / Total number of orders = $34,000 / 2,000 = $17 per order

Overhead cost assigned to S1 = Number of orders for S1 x Order Filling overhead rate

= 400 orders x $17 per order

= $6,800

Therefore, total overhead cost assigned to S1 under activity-based costing = $11,520 + $6,800 + $128

= $17,448

The correct answer is D, $17,448.

Learning Objectives

- Calculate the allotment of overhead expenses for products and customers, guided by the principles of Activity-Based Costing.

Related questions

Flemming Corporation Uses Activity-Based Costing to Compute Product Margins ...

Delauder Enterprises Makes a Variety of Products That It Sells ...

Delauder Enterprises Makes a Variety of Products That It Sells ...

ScholfieldEnterprises Makes a Variety of Products That It Sells to ...

Bachrodt Corporation Uses Activity-Based Costing to Compute Product Margins ...