Asked by Teesean Patterson on Apr 30, 2024

Verified

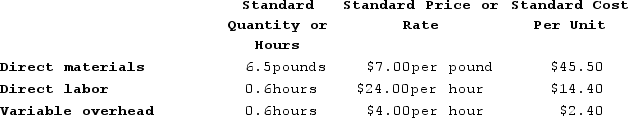

Kartman Corporation makes a product with the following standard costs:  In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor efficiency variance for June is:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor efficiency variance for June is:

A) $4,560 Favorable

B) $4,560 Unfavorable

C) $4,731 Unfavorable

D) $4,731 Favorable

Labor Efficiency Variance

The difference between the actual labor hours used and the expected (standard) labor hours for the level of production, multiplied by the standard labor rate.

Direct Materials

The raw materials that can be directly attributed to the production of a product and are a part of the finished product.

- Analyze the differences in workforce efficiency and compensation rates to gauge the adequacy of labor employment and wage rate oversight.

Verified Answer

TG

Trinity GodinaMay 06, 2024

Final Answer :

B

Explanation :

To calculate the labor efficiency variance, we need to compare the actual direct labor hours used to produce the units with the standard direct labor hours allowed for the production.

Standard direct labor hours allowed = Standard labor hours per unit x Actual output

= 1.6 DLH/unit x 3,500 units

= 5,600 DLH

Actual direct labor hours used = 2,290 DLH

Labor efficiency variance = Standard labor hours allowed - Actual direct labor hours used x Standard labor rate per hour

= (5,600 - 2,290) x $14 = $46,060 unfavorable

Therefore, the answer is B, $4,560 Unfavorable.

Standard direct labor hours allowed = Standard labor hours per unit x Actual output

= 1.6 DLH/unit x 3,500 units

= 5,600 DLH

Actual direct labor hours used = 2,290 DLH

Labor efficiency variance = Standard labor hours allowed - Actual direct labor hours used x Standard labor rate per hour

= (5,600 - 2,290) x $14 = $46,060 unfavorable

Therefore, the answer is B, $4,560 Unfavorable.

Learning Objectives

- Analyze the differences in workforce efficiency and compensation rates to gauge the adequacy of labor employment and wage rate oversight.

Related questions

Kartman Corporation Makes a Product with the Following Standard Costs ...

Boldrin Incorporated Has a Standard Cost System ...

Fortes Incorporated Has Provided the Following Data Concerning One of ...

Motts Incorporated Has a Standard Cost System in Which the ...

Reagen Corporation Makes a Product with the Following Standard Costs ...