Asked by Jared Jacobson on Jul 12, 2024

Verified

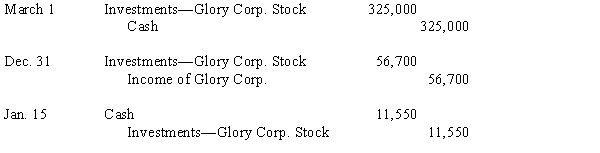

On March 1, Year 1, Chase Inc. purchases 35% of the outstanding shares of Glory Corporation stock for $325,000. On December 31, Year 1, Glory reports net income of $162,000. On January 15, Year 2, Glory pays total dividends to stockholders of $33,000.Journalize the three transactions.

Outstanding Shares

The cumulative quantity of a business's stocks that are distributed to and possessed by the stockholders.

Net Income

The amount of profit a company generates after accounting for all expenses, taxes, and costs.

Total Dividends

The sum of all dividend payments made by a company to its shareholders during a specific period.

- Understand how to journalize investment transactions, including purchases, income recognition, and dividends.

Verified Answer

Learning Objectives

- Understand how to journalize investment transactions, including purchases, income recognition, and dividends.

Related questions

The Income Statement for Dodson Corporation Reported Net Income of ...

Present Entries to Record the Following Selected Transactions of Masterson ...

Prepare the Journal Entries for the Following Transactions for Morgan ...

Prepare the Journal Entries for the Following Transactions for Batson ...

Journalize the Following Five Transactions for Newman & Associates, Inc ...