Asked by Manuel Rodriguez on Jun 21, 2024

Verified

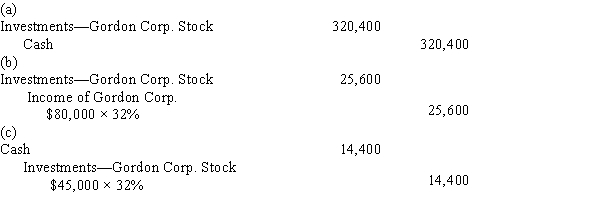

Prepare the journal entries for the following transactions for Morgan Co.(a)Morgan Co. purchased 32,000 shares of the total of 100,000 outstanding shares of Gordon Corp. stock for $10 per share plus a $400 commission.(b)Gordon Corp.'s total earnings for the period are $80,000.(c)Gordon Corp. paid a total of $45,000 in cash dividends.

Outstanding Shares

The total number of a company's shares that are currently owned by shareholders, including shares held by institutional investors and restricted shares held by company officers and insiders.

Cash Dividends

Money paid out to shareholders by a corporation, often as a portion of the company's profits.

Journal Entries

Records of financial transactions in the double-entry bookkeeping system, showing debits and credits made in accounts to maintain the ledger.

- Comprehend the process for recording investment transactions, such as acquisitions, income acknowledgment, and dividend distributions.

Verified Answer

Learning Objectives

- Comprehend the process for recording investment transactions, such as acquisitions, income acknowledgment, and dividend distributions.

Related questions

Prepare the Journal Entries for the Following Transactions for Batson ...

The Income Statement for Dodson Corporation Reported Net Income of ...

Present Entries to Record the Following Selected Transactions of Masterson ...

On March 1, Year 1, Chase Inc ...

Journalize the Following Five Transactions for Newman & Associates, Inc ...