Asked by Julia Guerrero on May 30, 2024

Verified

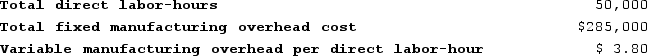

Prather Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job P513 was completed with the following characteristics:

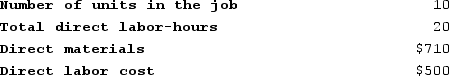

Recently, Job P513 was completed with the following characteristics:

The amount of overhead applied to Job P513 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job P513 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $76

B) $190

C) $266

D) $114

Plantwide Predetermined Overhead Rate

A single overhead rate calculated for an entire manufacturing plant, applied to all units produced irrespective of department or product differences.

Job-Order Costing System

A cost accounting system that assigns costs to specific production batches or jobs, useful for customized orders.

Direct Labor-Hours

The amount of labor time consumed by workers who are directly engaged in the manufacturing of products, serving as a critical factor in costing and production planning.

- Determine the overhead allocation for particular tasks according to the rates established by various departments.

Verified Answer

Direct materials cost for Job P513 = $500

Direct labor cost for Job P513 = $200 (40 hours x $5)

Predetermined overhead rate = $5 per direct labor-hour

Overhead applied to Job P513 = Predetermined overhead rate x Actual direct labor-hours worked on Job P513

Overhead applied to Job P513 = $5 x 38 = $190

Therefore, the closest amount of overhead applied to Job P513 is $190, which is option B.

Learning Objectives

- Determine the overhead allocation for particular tasks according to the rates established by various departments.

Related questions

Sanderlin Corporation Has Two Manufacturing Departments--Machining and Finishing ...

Comans Corporation Has Two Production Departments, Milling and Customizing ...

Use the Data for Wall Nuts,Inc ...

Use the Data for Wall Nuts,Inc ...

Trevigne Corporation Uses a Predetermined Overhead Rate Base on Machine-Hours ...